Hello Jeff,

Every Monday morning, the first thing I do is look for your column. You’ve been my legal guide for so long, and I really appreciate the help.

Is there anything I should know about taking money from a candidate?

A hiring manager wants to make an offer to my candidate, but the COO doesn’t want to pay the placement fee. The position has been open for 9 months, and my candidate is the right person for the job.

At the behest of the director of HR, I sent this candidate to use as an inducement for the COO to hire him. I have a signed agreement with the client to pay the placement fee if it hires anyone I refer.

It’s the candidate’s dream job at a dream compensation. Now HE wants to pay the fee.

On one hand it doesn’t feel right, on the other hand I have the power to make the candidate whole.

This seems so simple, but I just wanted to run it by you.

What do you think?

Thanks in advance, and thanks for helping me get this far!

Dean Mannello The Sherwood GroupIt’s Not That Simple

Hi Dean,

JOC inquiries like yours help all recruiters to know the law. That’s our mission. Thank you for not only helping us, but letting us know it’s “Mission Accomplished!”

Your desire to help the candidate says volumes about you. Truly, you make me proud.

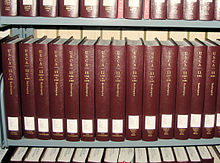

The candidate’s offer to pay you says volumes about you too. Unfortunately, some of those volumes are the Federal Register, the United States Codes, the Code of Federal Regulations and the 50 bound state statutes. Law galore.

The candidate’s offer to pay you says volumes about you too. Unfortunately, some of those volumes are the Federal Register, the United States Codes, the Code of Federal Regulations and the 50 bound state statutes. Law galore.

The Federal Trade Commission (FTC) and that all-powerful Dodd-Frank-created federal Consumer Financial Protection Bureau (CFPB) are among the federales trying to figure out what to do with you. They’re happily helped by your state consumer protection and licensing agencies.

Your private deal – even if the candidate just writes you a check with nothing else in writing — creates an applicant-pay-fee (APF) contract. Unlike the business-to-business relationship of an employer-pay-fee (EPF) search, this is a consumer transaction. That legal lampoon makes all the difference on the placement planet.

A Credit Card Application?

A properly-drafted APF contract looks like a credit card application. That’s because it basically is!

Compliance with the statutory notices, truth-in-lending requirements, and mandatory statements are heavily regulated by the federal government under the Fair Credit Reporting Act (15 USC 1681, et seq.) and other federal and state laws. The forms often have to be submitted to a governmental agency for approval prior to their use. Many of the states also require a license to place on an APF basis.

You might ask, “Why? There was no credit extended. There was no payment plan. It was just a simple payment to a recruiter for a (very valuable) service rendered. How complicated is that?”

Unfortunately, ve-r-r-ry. The FCRA is used to give the FTC and the states broad power over private contracts.

The unfairness of this to you is obvious. But the unintended consequences of a federal or state investigation and punishment are obvious too.

So your instinct was right, Dean. It’s one of the risks in “running with an MPC” (Most Placeable Candidate).

I’d lean on the client with a major guilt trip, but I’d make the placement anyway. You didn’t get the COO to pay, but everyone that matters to him will know it.

. . . and think of all our Fordyce family members you helped!

For more information on the many placement management issues:

- Go to www.placementlaw.com.

- Click the Placement Manager’s Law Quiz button on the bottom row.

- Take the PMLQ.

- Click the Answers to Placement Law Quizzes button on the bottom row.

- Grade yourself.

Get back to placement payment, because on this one it’s . . .

Mission Accomplished!

Thanks again,

Jeff