![]() Job board operator Dice Holdings turned in a financial performance in the 2nd quarter that was in line with Wall Street’s expectations.

Job board operator Dice Holdings turned in a financial performance in the 2nd quarter that was in line with Wall Street’s expectations.

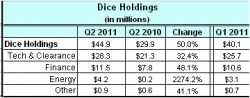

Reporting this morning before the U.S. markets opened, Dice reported it earned 11 cents a share on revenue of $44.9 million. Dice beat the Street’s high-end revenue prediction by almost $1 million. Revenue was 50 percent higher than in the 2nd quarter last year, due in part to acquisitions last year, as well as a 48 percent increase from eFinancialCareers, especially in the U.K.

For the current quarter, the company said it expected to earn 13 cents a share, which is what analysts were expecting to hear.

The largest company segment was tech and clearance, where revenue from the company’s flagship tech site, Dice.com, and from ClearanceJobs.com, was 32 percent ahead of the same quarter last year.

Scot Melland, Dice chairman, CEO and president, said business on the tech site in particular “continued to grow nicely.” Speaking during a conference-call presentation this morning, he predicted “the healthy tech recruiting market to continue for the forseeable future.” Financial recruiting, he said, will “moderate” some in the second half of the year.

Scot Melland, Dice chairman, CEO and president, said business on the tech site in particular “continued to grow nicely.” Speaking during a conference-call presentation this morning, he predicted “the healthy tech recruiting market to continue for the forseeable future.” Financial recruiting, he said, will “moderate” some in the second half of the year.

He also offered an opinion that the job market, while hardly robust and weaker now than it was a few months back, is “not as bad as people think it is.” The recovery, he said, “really is a sector story,” pointing out that tech, healthcare, even manufacturing have been improving more rapidly than finance, construction, or government, which are either cutting jobs or struggling to stay even.

In response to a question about the impact of LinkedIn, Melland observed that while investors have only started paying close attention since LinkedIn announced its IPO a few months ago, Dice and other recruitment publishers have been competing with the company for several years.

“They (LinkedIn) get a piece of the business,” he said, ” We get a piece.”

“Customers,” he added, ” generally buy both services because they use us in different ways.”

Dice stock climbed sharply after the market’s opening, rising to $14.61 from its close, Monday, at $13.44 a share. It has since fallen back to $14.09, up 4.84 percent on the day. The Dow, meanwhile, is off .44 percent.