The bankruptcy filings for CareerBuilder + Monster are now publicly available—and they reveal details about the company’s ownership structure and outstanding debts. Filed in Delaware on June 24, the Chapter 11 documents confirm the company’s plans to liquidate and sell off its core business units under court supervision.

The filings offer the clearest picture yet of the state of the business when it declared bankruptcy.

Corporate Ownership and Holding Structure

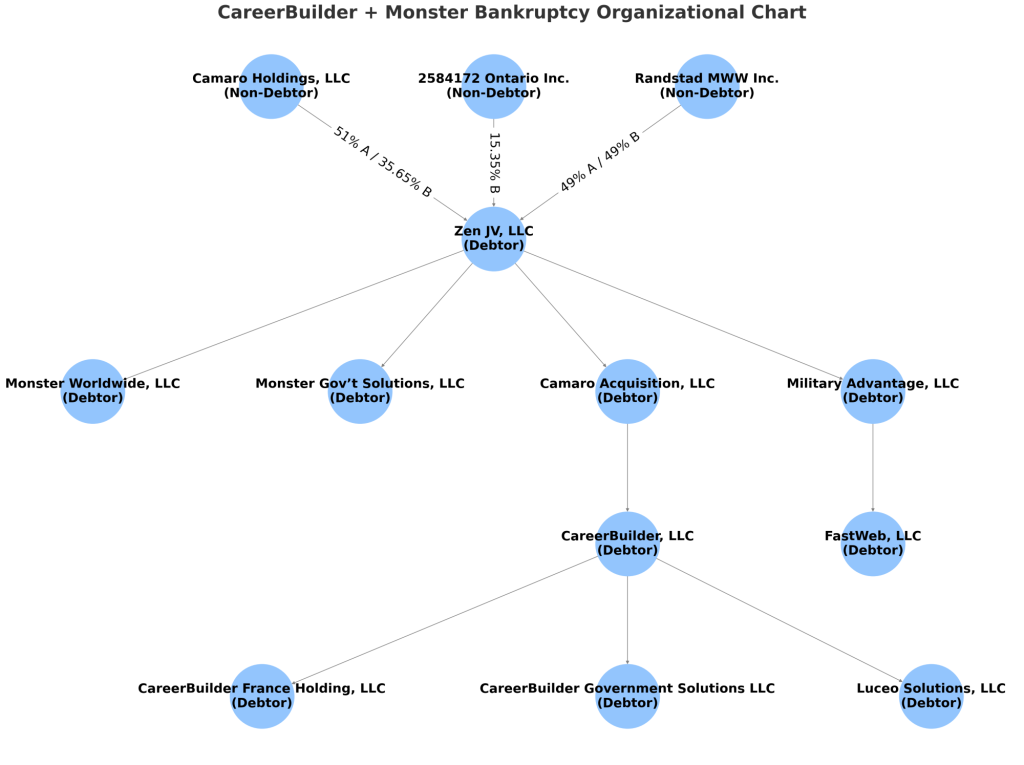

The Chapter 11 petition was submitted by Zen JV, LLC, the parent holding company created when Apollo Global Management and Randstad merged CareerBuilder and Monster in 2024. Zen JV owns a network of affiliated companies, all of which are included in the filing:

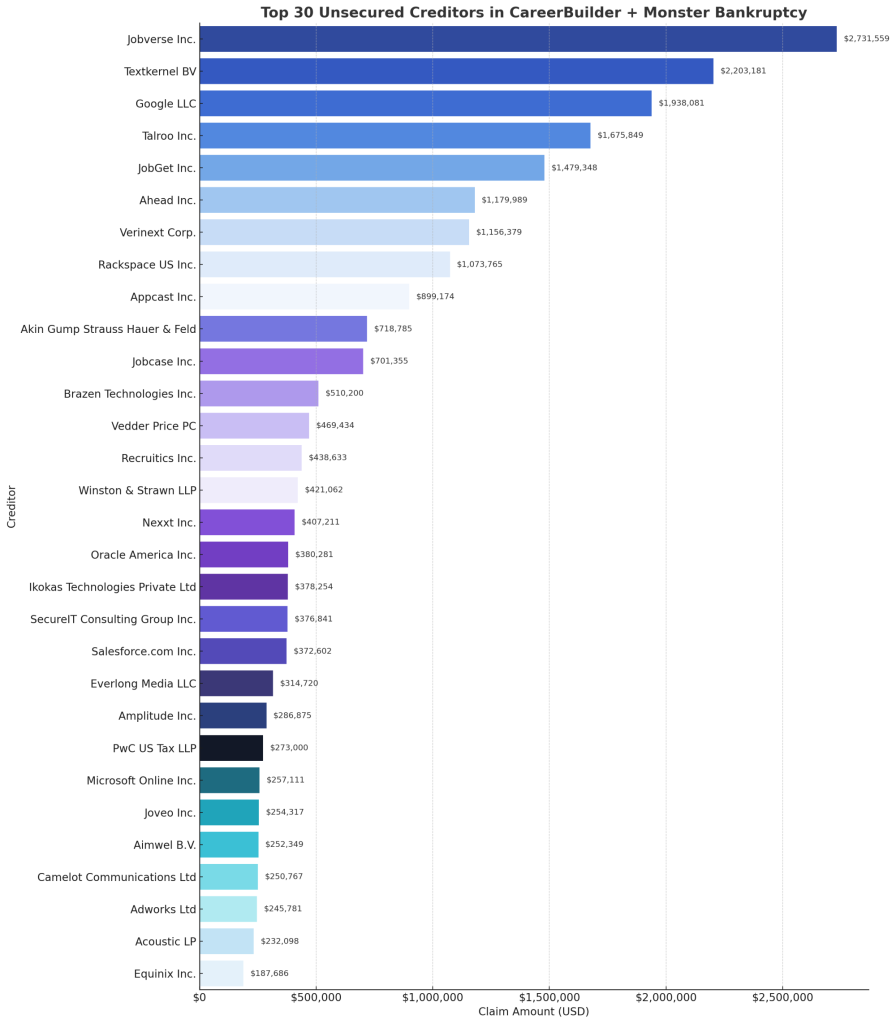

$100M+ in Unsecured Debts

The structure effectively separates the liabilities of the operating companies from their private equity and strategic investors, Apollo Global Management and Randstad. The filings estimate those debts between $100 million and $500 million, while the company only has assets between $50 million and $100 million.

The company does not expect to pay any of its unsecured creditors, which include recruiting technology companies, technology infrastructure providers, and legal firms.

Next Steps in Asset Sales

As ERE has previously reported, CareerBuilder + Monster has signed stalking-horse agreements to sell its assets:

- Job Board Division: The core job board assets of CareerBuilder and Monster—long the most visible part of the business—will be sold to JobGet Inc., a platform specializing in hourly job seekers.

- Media Brands: Valnet Inc., which operates more than two dozen media properties, will acquire Military.com and Fastweb.com, two of the company’s major digital content sites.

- Government Services: Valsoft Corporation, a Canadian firm known for acquiring vertical software companies, will take over Monster Government Solutions, which provides talent software to federal and state agencies.

These baseline offers will establish the minimum purchase price in a court-supervised auction process that may attract competing bids. The company has also secured debtor-in-possession financing from BlueTorch Capital — a special type of loan that allows bankrupt companies to continue operating during the restructuring or wind-down process, under court oversight.