![]() A slowdown in tech hiring among the long tail — smaller firms outside the major markets — coupled with a falloff in financial services hiring has prompted Dice Holdings to reduce its revenue and earnings outlook for the rest of this year.

A slowdown in tech hiring among the long tail — smaller firms outside the major markets — coupled with a falloff in financial services hiring has prompted Dice Holdings to reduce its revenue and earnings outlook for the rest of this year.

Despite beating analyst expectations on earnings, and missing on revenue by less than 1 percent, Wall Street responded to the lowered expectation by selling down the stock. Dice saw its stock price slip by just over $1 a share. In late trading today Dice was selling at $7.20 a share, a 12.5 percent drop.

While reporting earnings of 14 cents a share versus the 13 cents Wall Street expected, Dice officials declared themselves “disappointed” with the company’s performance. In April, Dice predicted Q2 revenue of $49 million, versus the $48.46 million it reported.

The company also lowered full-year revenue by $10 million to $189 million, and said the current third quarter revenue would be $47 million.

“Q2 is not the quarter we expected,” Chairman and CEO Scot Melland told analysts on a conference call this morning. “We were surprised by the quick change in the environment in Q2.”

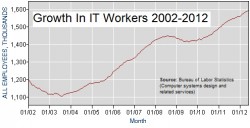

Tech hiring, still strong in tech centers such as Silicon Valley, New York, and Boston, has fallen off elsewhere, especially among smaller companies.

“Tech is still tight,” Melland explained in response to an analyst’s question. “But it tends to be tight in the tech centers. When you get outside of the tech industry and the tech centers, it’s a different story.”

The company’s tech and clearance sector generated $32.2 million. Dice.com, the company’s tech flagship, was responsible for most of that. So far, the sector is about $9.4 million ahead of last year. But growth slowed in the second quarter, when the sector increased revenue by $3.99 million over last year, about $1.4 million less than in Q1.

The company’s tech and clearance sector generated $32.2 million. Dice.com, the company’s tech flagship, was responsible for most of that. So far, the sector is about $9.4 million ahead of last year. But growth slowed in the second quarter, when the sector increased revenue by $3.99 million over last year, about $1.4 million less than in Q1.

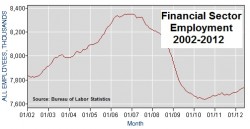

eFinancialCarrers did worse than last year by $1.76 million. It’s as much a sign of a slowdown in hiring in financial services worldwide, as it is a failure to launch. The sector was expected to show signs of improvement by now. Although data from the U.S. Bureau of Labor Statistics points toward some growth in the U.S., the site’s revenues have been heavily impacted by hiring cuts in the rest of the world.

Outlining the current hiring conditions, Melland said it’s mostly the smaller customers who have been reducing their recruitment advertising. Speaking principally about Dice.com, he said the bigger customers are renewing their con tracts and in some cases upping their spend. The smaller users, he said, are telling the sales staff they have no current hiring needs. The second principal reason for not renewing, he said, was cost.

tracts and in some cases upping their spend. The smaller users, he said, are telling the sales staff they have no current hiring needs. The second principal reason for not renewing, he said, was cost.

The human resource professionals with whom they deal explain that there is less of an urgency now to fill positions, said Melland. With more lead time, recruiters turn to their pipelines, and to LinkedIn to source candidates for the jobs that do come open.

“I think what you’re seeing, especially in the small customer segment, when the urgency is less recruiters have more time, and when they have more they are willing to spend more on sourcing,” he explained. Although they may be using LinkedIn, and that’s having a greater impact on revenue now than in the past, Melland said it was rare a company makes an either/or choice.

Next week, both LinkedIn and Monster will report 2nd quarter financial results. LinkedIn, which reports August 2nd, is expected to have revenues of $216.08 million, and earn 16 cents a share. Monster, which reports 61/2 hours earlier that same day, is expected to have earned 6 cents a share on revenue of $243.48 million. CareerBuilder is not a public company and discloses only its North American revenue.