Monster’s after-hours stock price surged late today, following the release of the company’s third quarter numbers that showed revenue and bookings improving faster than most analysts expected.

Monster’s after-hours stock price surged late today, following the release of the company’s third quarter numbers that showed revenue and bookings improving faster than most analysts expected.

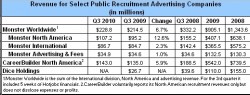

Bookings, which are the contracts for job postings and resume access, jumped 26 percent, while revenue came in at $228.8 million, a 6.7 percent increase over the same period in 2009. Deferred revenue also grew, jumping 18 percent over the same period last year.

Investors ignored Monster’s 5 cent a loss share. It was due to expenses associated with the HotJobs acquisition, which closed during the quarter. Without those expenses, and not including the $7.7 million in HotJobs revenue, Monster would have earned a penny a share.

Sal Iannuzzi, Monster’s chairman and CEO, was almost ebullient during the evening conference call with analysts. Monster is on the right track, he said, reporting that its investment in its 6Sense technology is paying off, with Power Resume Search capturing some 45 percent of the search bookings. The Career Ad Network is growing, he said, with plans in the works to expand it into 14 international markets in the coming months.

Iannuzzi predicted a “strong and profitable 2011,” emphasizing the profitable, promising that half the company’s incremental revenue would go to the bottom line. The goal, he told analysts, is to eventually get the company to a 25 percent margin.

Of course, all of those plans could evaporate should the world economy reverse course. While Iannuzzi admitted to being a “little gun shy” considering the conditions of the last two years, most economists expect steady, if slow, improvement. Actually, so does Monster, which predicted that the current (4th) quarter would continue to see a robust growth in bookings — somewhere between 27 and 32 percent growth over last year, including HotJobs’ contribution.The company expects to earn 4 to 8 cents a share in the quarter. The average of current analyst estimates is 5 cents a share. Monster also lowered its full year loss forecast to between 5 and 9 cents a share.

Meanwhile, Monster’s closest rival CareerBuilder reported North American revenue of $143 million, a 5.9 percent increase over the same quarter in 2009. The privately held company volunteers only some numbers. It doesn’t report its international sales or other revenue, nor does it disclose its expenses. The company, owned by newspaper publishers Gannett, McClatchy, and Tribune, and Microsoft, is profitable.

Dice Holdings, owner of IT job board Dice.com and other leading niche sites, is scheduled to report its 3rd quarter results on Tuesday.