Monster’s stock price took a hit this morning after Wachovia Capital Markets downgraded the job board’s securities to an “underperform.”

Monster’s stock price took a hit this morning after Wachovia Capital Markets downgraded the job board’s securities to an “underperform.”

The stock price dropped 8.7 percent at the opening from Friday’s close of $12.45. It has since recovered and at midday in New York, the last trade price was back to where it was.

However, the comments by analyst John Janedis accompanying the downgrade may have a lingering effect. In downgrading the stock, Janedis bases it on his belief that “the slope of the eventual recovery will be flatter than anticipated.” He doesn’t see much economic steam being built until 2010. Even when hiring does begin to perk, the company’s “future earnings power will be below the last peak due to structural changes in the industry.” The discounting that all the major job boards are offering now will have have a significant impact, Janedis says.

Though the note doesn’t provide details, the structural changes that recruitment advertising is undergoing include the shift to niche job boards, an emphasis on employer career sites with search engine marketing to drive traffic directly to the company site, and a flirtation with social media. Had it not been for the economic collapse, the flirting might now be a full-fledged relationship.

If Janedis is right — and many economists agree with his prediction of a slow recovery and a soft improvement in hiring — then more recruiters will be experimenting with search engine marketing and with social media recruiting, since the pressure to fill jobs won’t be as keen as it was just 24 months ago. If they find success there, then Monster and its competitors won’t be able to bump prices and discounting will be the norm.

With that scenario in the background, Janedis writes, “We think MWW’s business will have earnings of $0.69 in 2012, or 52% below the $1.43 peak in 2007. We are currently modeling 10.6% operating margins in ’12 vs. mgmt’s previous target for ’08 of 25%.”

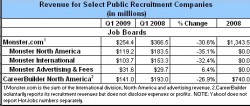

As a public company, Monster’s finances are reported on a quarterly basis. Yahoo, which owns HotJobs, is also a public company, but chooses not to separately disclose HotJobs revenue, instead including it with the company’s overall numbers. CareerBuilder, owned by newspaper publishers and Microsoft, is not required to report publicly, but it does voluntarily provide its quarterly North American revenue. For the first quarter, CareerBuilder said it brought in $141 million. That was off 27 percent from the same quarter the year before.

As a public company, Monster’s finances are reported on a quarterly basis. Yahoo, which owns HotJobs, is also a public company, but chooses not to separately disclose HotJobs revenue, instead including it with the company’s overall numbers. CareerBuilder, owned by newspaper publishers and Microsoft, is not required to report publicly, but it does voluntarily provide its quarterly North American revenue. For the first quarter, CareerBuilder said it brought in $141 million. That was off 27 percent from the same quarter the year before.

Both HotJobs and CareerBuilder are beset by the same problems as Monster, though HotJobs may be even worse off. Its staff has always been smaller than either Monster’s or CareerBuilder’s and, because of its alliance with hundreds of U.S. newspapers, which are in the throes of the worst advertising depression in their history, we think its revenue has been hit even harder. CareerBuilder long ago built an independent outside and telemarketing sales force. So even though it, too, is partnered with Gannett, Tribune, and McClatchy media properties, it is far less dependent on their sales staffs.