![]() Even Monster’s CEO had a hard time finding much to be optimistic about in the company’s 2nd quarter performance.

Even Monster’s CEO had a hard time finding much to be optimistic about in the company’s 2nd quarter performance.

There’s some improvement in bookings in North America; Power Resume Search, with its premium pricing is beginning to gain some traction in Europe; and the big Kforce deal is the first of several in the admittedly slow process of being forged with staffing companies.

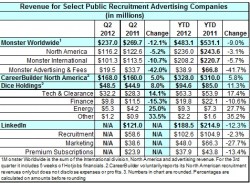

Potential, however, doesn’t trump results, and the numbers for Monster’s last quarter were not entirely what Wall Street was expecting. The company reported earning 6 cents a share after adjustments, in line with predictions. But revenue was $237 million, some $6 million below the average of analysts’ estimates of $243.3 million.

(CareerBuilder, a privately held company, said its North American revenue was $160 million, up 6.7 percent over the same quarter last year. The company doesn’t release other revenue numbers, nor does it publicly report expenses or earnings.)

Monster officials cautioned a few months back that the business was softening along with the global economic conditions, and downsized expectations for both revenue and earnings. Revenue for the quarter came in at the low end of their estimates, while the per-share earnings were in the middle.

Monster officials cautioned a few months back that the business was softening along with the global economic conditions, and downsized expectations for both revenue and earnings. Revenue for the quarter came in at the low end of their estimates, while the per-share earnings were in the middle.

Despite that, the stock was hit hard as soon as trading began on Wall Street with shares plunging by more than a dollar to $6.00.

Traders were not buoyed by some of the positive developments, including an increase of 14 percent in North American bookings, with the company’s newer products — 6Sense (the Power Resume Search) and SeeMore (a cloud-based app using 6Sense search — increasing their share. Instead, it was a reaction to both the 2nd quarter results as well as new warnings from the company about the current quarter.

Monster is expecting its third quarter to be down 6 to 12 percent from the same quarter last year. Earnings per share are estimated in the range of 2 to 7 cents, well below last year’s 13 cents.

“The global business environment continues to be weak,” Sal Iannuzzi told analysts during a morning conference call before the New York markets opened. Iannuzzi, Monster’s chairman, president and chief executive officer, said the company’s performance was consistent with the changes in the global economy, which are now affecting more of Europe, including Germany, and Asia Pacific. The weakness in these markets, he said, will continue throughout the third quarter.

Nevertheless, he said the company has now deployed its 6Sense search technology more broadly, and is seeing interest from Europe, though it’s muted by the spreading economic slowdown there. In the United Kingdom and France, where the 6Sense platform has been available for more than a year, adoption is strong, in the range of 50 percent, Iannuzzi said. Elsewhere in Europe, where the availability is more recent, adoption is under 25 percent.

The large staffing companies are showing a greater interest in 6Sense, which makes resume searching quicker and more efficient since it’s a far more sophisticated method than traditional keyword and field range searching. Iannuzzi said companies that have beta-tested 6Sense have been impressed enough to begin discussing terms and deployment. But, in response to an analyst’s question, he acknowledged that new technology sales take more time. When deals will be closed, he said, “would be a hot in the dark.”

LinkedIn, which is expected to report strong sales and earnings, will release its second quarter numbers this afternoon, following the close of the market.