Monster is a winner today on Wall Street; its stock up more than 16 percent at one point after reporting earnings that were double what analysts forecast.

Monster is a winner today on Wall Street; its stock up more than 16 percent at one point after reporting earnings that were double what analysts forecast.

It closed at $8.93; up 9.44 percent.

In the first quarter, the company saved its way to a 4 cent per share profit, not including one-time expenses or income. Though less than last year’s 5 cents, the earnings reflected the commitment Chairman and CEO Sal Iannuzzi made in previous financial reports to strengthen the company and keep a lid on expenses.

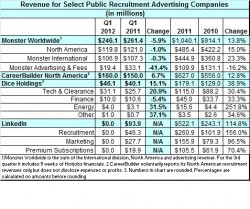

The $246.1 million in revenue the company reported was 6 percent below last year’s $261.4 million, with declines in each of its three sectors: North America, international, and advertising and fees. Savings from staff reductions and general restructuring helped make up the difference.

Counting all expenses, including one-time restructing charges and a restitution of $5.4 million in connection with the stock back-dating cases from the mid-2000s, Monster earned 3 cents a share. Last year it earned nothing.

Speaking during a conference call with analysts, Iannuzzi expressed a cautiousness about the future, as well as guarded optimism. Bookings, an indication of future business, were up in the first quarter by 8 percent overall, Iannuzzi said. North American bookings were up 6 percent, and 9 percent internationally, helped by a $23 million contract with the UK’s Department for Work and Pensions.

He also said that the company’s products, especially SeeMore and its 6Sense search technology, have been performing well with demand for them powering many of the booking deals, including the one with the DWP. “The new products” he said in answer to a question, “are really beginning to get more traction.”

However, he cautioned that global employment growth is facing stiff headwinds.

He predicted that “current uncertainty and market volatility” will continue during this second quarter, pointing out that earlier in the year, “Many predicted a steadily improving global economy. That view has now changed and many fear a failure of the economy and weakening business conditions, particularly in Europe. The optimism of last quarter was overstated.”

Consequently, Monster says it expects bookings to be in a range from +1 percent to – 5 percent. Revenue is expected to be down 8% to down 4% compared to the second quarter 2011 of $259 million. Second quarter earnings are expected to be in the range of 4 cents to 8 cents per share.

Before opening the session to questions from analysts, Iannuzzi said he wouldn’t provide anything new about the potential sale of the company, or other alternatives.

During the Q&A Iannuzzi said business from staffing firms was “a bright spot,” as that sector continues to grow. “I think the staffing companies understand we have more to offer.”

On pricing, he said Monster intends “to be extremely aggressive,” competing with other career services on that basis, and also on “the strength of the solution.”

Overseas, Iannuzzi said, there’s been a slowdown, even in the previously strong German economy. “Across Europe you are seeing, I wouldn’t call it a disastrous situation,” Iannuzzi said, observing that job revenues in more than one country were down by double-digit percentages. “Every country in Europe has slowed down.”

“For the time being, we don’t see a significant change,” Iannuzzi said, speaking of international economies and the U.S., too, “Up or down.”

Next week, LinkedIn reports its 1st quarter financial results. The careers and business networking site has been reporting steady, strong growth for several quarters even before going public a year ago. Investors will be watching on May 3 to see if the company can beat the Street, as it has in the past. Analyst estimates are for a 9 cent per share profit on revenue of $178.36 million.