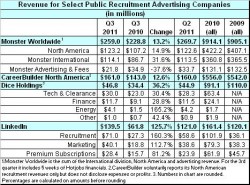

LinkedIn lost money, but still beat analyst estimates, blowing through the most optimistic projections by millions and ending the quarter with $139.5 million in revenue. The company also announced it would sell $100 million more of its shares to finance its aggressive expansion.

LinkedIn lost money, but still beat analyst estimates, blowing through the most optimistic projections by millions and ending the quarter with $139.5 million in revenue. The company also announced it would sell $100 million more of its shares to finance its aggressive expansion.

The company told investors and analysts during a conference call after the markets closed this afternoon that it would add some 500 to 600 more employees by the end of the year. CEO Jeff Weiner said the rapid expansion would give LinkedIn a jump on 2012.

Because of SEC rules and legal cautiousness, company officials didn’t discuss the planned stock sale during the call. But Weiner and CFO Steve Sordello said they would be bringing in more tech people to speed up the launch of new products and scale its operation to accommodate the rapid growth. Sales people would also be added now so they’ll be in place to begin selling with the new year.

Sordello said the company was on pace to bring in between $154 and $158 million in the current quarter. That would give it between $508 and $512 million for the year.

The company has been on such a tear, that one analyst questioned whether its revenue and earnings projections might be too conservative.

For the third quarter, the company reported a per share loss of 2 cents. The analyst consensus was for a 4-cent loss. Adjusting for one-time and non-operational expenses, LinkedIn earned 6 cents a share. The consensus for that calculation was that the company would break even.

Showing that it’s not just growing money, Weiner and Sordello noted the company’s global expansion and reported that 59 percent of its 135 million members are international. The fastest growing group is college students and recent grads. Weiner said helping them find their first job is a company priority.

Its traffic has also grown rapidly. The site now averages about 87.6 million unique visitors monthly, a figure the company said is low since it doesn’t include mobile users who, by company metrics, now account for something “north of 10 percent” of page views.

“Mobile is far and away our fastest growing product and service,” said Weiner adding, “we’re thinking through how to monetize mobile and we’re hoping to begin that next year.”