So often pronounced dying, dead, and all but useless for job seekers and employers alike that it’s passing into legend, job boards somehow manage to rise phoenix-like from the ashes of their pyres to successfully deliver candidates and hires to employers worldwide.

So often pronounced dying, dead, and all but useless for job seekers and employers alike that it’s passing into legend, job boards somehow manage to rise phoenix-like from the ashes of their pyres to successfully deliver candidates and hires to employers worldwide.

For being so out of fashion, so yesterday, job boards manage to come out on top or top-adjacent on nearly every source of hire study. In a Bersin & Associates survey this fall job boards tied for first with internal transfers as the leading source of all hires. CareerXroads says job boards produced 24.9 percent of all external hires in 2010, second only to employee referrals (27.5 percent).

The latest survey comes from tech vendor Talent Technology, which reports that job boards are the leading source of candidates, according to the 1,100 North American HR professionals who participated. Job boards account for 17 percent of the candidates, followed by employee referrals, which provide 15.8 percent.

What’s remarkable about the evidence is how few accept it. Even after reporting that “job boards remain popular and are used to fill 19 percent of open positions – making job boards the No. 1 source for candidates,” Bersin titled that section of the report “Job Boards: Not Dead, but Dying.”

Even more remarkable is how little the job board industry has done to promote itself. The major boards have their own, proprietary data, guarded more carefully than the U.S. does its diplomatic messages. Second tier and certainly mom-and-pop operations have little data beyond gross traffic counts. So for all practical purposes employers do their own market surveillance.

Now, finally, seven years after it’s founding by Peter Weddle, the International Association of Employment Web Sites has bestirred itself to do some serious research about the industry.

Now, finally, seven years after it’s founding by Peter Weddle, the International Association of Employment Web Sites has bestirred itself to do some serious research about the industry.

Financed by Jobg8, the job board industry’s candidate marketplace, 100 sites participated last summer in the first benchmarking survey of commercial employment sites. Before you get too hopeful about the prospects, know that none of the biggest job boards participated, the survey was designed for the benefit of the industry, and most of the results aren’t being shared publicly. Those that are may be helpful to some buyers; they’re certainly interesting. More important is that it gives individual sites a yardstick against which to measure their own results.

“It was,” confessed Matt Hoffner, president of Jobg8?s Americas operation (the company is HQd in the UK), “a lot harder than we thought … Just getting all the terms right was quite a challenge.”

![]() Still, after struggling through some 65 questions and their accompanying 22 footnotes, the industry found:

Still, after struggling through some 65 questions and their accompanying 22 footnotes, the industry found:

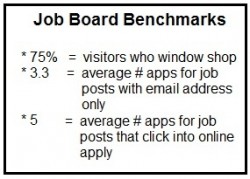

- Three-quarters of a job board’s visitors are “window shoppers” who neither apply for a job nor register. That suggests there’s a high degree of self-selection that occurs, as the next point demonstrates.

- Job postings that direct to a company’s ATS get five applicants on average. Those with only an email address get 3.3 applications. Niche sites and those in business more than three years have slightly higher apply rates.

- Job aggregators (the Indeeds and SimplyHireds) provide about 22.8 percent of a U.S. site’s traffic and only 11.6 percent in Canada. Depending on the region, sizable percentages also came from the job board’s own search optimization efforts and their pay-per-click campaigns.

- The average site has 3.5 employees; 22 percent have one or less; 9 percent have 30 or more.

- Individual marketing expenses varied widely, ranging from 1 to 14 percent. The average is 6.7 percent of revenues spent marketing the site.

Hoffner observed that the industry is increasingly aware it needs to do a better job telling its story. From the survey discussions that took place at meetings in Ft. Lauderdale, during the IAEWS Congress in September, and in London, Hoffner said there was a “clear understanding that we can’t sit still.” The public part of the report says, “Job board owners are looking for new sales and marketing models and resources but expect that promotion and sales efforts will increase in 2012 and beyond.”

One powerful motivator for putting more effort into promotion, besides simply to stand out from the huge number of job boards in the world, is that organic traffic produces better results than that from aggregators. Says the published report: “Many participants stated that aggregator traffic was expensive and may not yield the same rate of applications or registered users as traffic from other sources.”

Board operators are also looking at a changing pricing model. Most sites still charge a fee to post a job; a few charge employers for each click. Hoffner says a “pay per applicant model came in for discussion. It’s an evolving pricing model that has the operator share risk with the customer. That’s a direction they seem to be heading toward.”