Dice had a strong first quarter, as quickening tech hiring boosted the company’s revenues, helping it to beat analysts’ estimates by a comfortable 2 cents a share.

Dice had a strong first quarter, as quickening tech hiring boosted the company’s revenues, helping it to beat analysts’ estimates by a comfortable 2 cents a share.

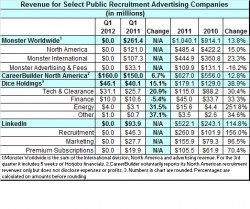

Dice Holdings, Inc., owner of several niche job boards, reported earning $8.6 million on revenues of $46.1 million, or 13 cents a share. Wall Street investors liked what they heard, bidding up Dice shares by 7.18 percent. The stock closed at $10.30 and was headed somewhat higher in after-hours trading.

While the company’s flagship Dice.com accounted for the bulk of the revenue at $31.1 million, the energy industry sector saw the fastest growth, increasing to $4 million versus last year’s $3.1 million. Only its eFinancial boards saw a decline, reflecting the general softness of the financial industry worldwide.

Scot Melland, chairman, president, and CEO, said, “We continue to be focused on building our customer base, with good progress at Dice and Rigzone (energy) in the quarter, while investing in additional features and functionality across each of our brands. In addition, the build out of our energy business is progressing nicely, fostered by the integration of our two energy sites into the new Rigzone service.”

Looking ahead, the company predicted it would end the year about 11 percent ahead of last year. Revenues were predicted to be $198 million versus $179 million for 2011. The current quarter was forecast to be 9 percent higher than last year.

Monster, which is to report its first quarter results Thursday morning, is expected to show revenues off by about 8 percent and a much bigger decline in earnings. Analysts, which had been expecting Monster to earn 9 cents a share a few months ago, now are forecasting 2 cents. If that’s what it turns out to be, then the decline will be 60 percent from last year’s 5 cents a share.

Forbes says, “Analysts are split on Monster, but six of 12 analysts rate it hold. Wall Street has warmed to the stock over the past three months, with the average analyst estimate increasing to moderate buy from hold. Last quarter, six of 12 rated it a buy and one rated it a sell.”

That warming is mostly due to the company’s decision to sell all or part of itself. Chairman and CEO Sal Iannuzzi said in March that Monster would seek “strategic alternatives.” He later made clear that he included a sale among those alternatives.

CareerBuilder, which is majority owned by media giant Gannett, said it had North American revenues of $160 million for the first quarter. That’s a 6.7 percent increase over the $150 million it reported last year. The privately owned company voluntarily discloses only its North American revenue, though it has operations worldwide.