Despite a first quarter loss, Monster executives told analysts Thursday the company is in good shape considering the sour global economy and that it is growing in brand strength and market share.

“We are gaining market share,” declared CEO Sal Iannuzzi. “We are declining less than the competition.” Instead of splitting a million dollars among Monster and one or two other job boards, Iannuzzi said employers are spending less but giving it all to Monster.

“Competition is stiff,” he said. Price discounting so steep he called it “stunning,” is common. And though he said Monster won’t “give away the product,” his marching orders to the sales force are “take market share.”

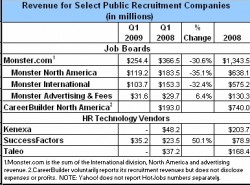

He didn’t mention any other company, but it was unmistakable that he was talking about CareerBuilder and, to a less extent, HotJobs. Neither company reports its financials completely. CareerBuilder is a private company owned by a group of newspaper companies and Microsoft and voluntarily shares its North American revenue. (Those figures weren’t available.) Hotjobs is a division of Yahoo, which does not separately identify the revenue.

In pursuit of share Monster spent $27 million during the first quarter on marketing its redesigned site and its new features. After a five year absence Monster returned as a Super Bowl advertiser this year, and also partnered with the NFL in a fan promotion to hire a “Director of Fandemonium.”

CFO Tim Yates said the $27 million was specifically for the launch of the new Monster site and won’t be repeated again this year. Without that expense and an additional $15 million in such one time expenses as $4.6 million in severance payments and legal expenses of $3 million connected with the stock option backdating affair, Monster would have been in the black for the quarter.

Even so the loss, amounting to $10.3 million or 9 cents a share, beat Wall Street’s estimates of an 11 cent per share loss. It came on revenue of $254 million, Monster’s smallest since the end of 2005.

Even so the loss, amounting to $10.3 million or 9 cents a share, beat Wall Street’s estimates of an 11 cent per share loss. It came on revenue of $254 million, Monster’s smallest since the end of 2005.

Monster’s expense cutting over the last several months has been significant, Iannuzzi and Yates reported. Salaries, administrative costs, and office expenses totaled $184.5 million for the quarter compared to the same quarter last year when those expenses amounted to $214.3 million. A big part of that comes from a 400 employee decline in staff.

To further reduce expenses, Yates said the company has eliminated cash bonuses, paying them in stock options, and has halted contributions to employee 401(k) accounts.

During the financial call, the marketing expense and the product launch came in for close questioning, as analysts asked about the effectiveness of the new site features with users and customers.

Darko Dejanovic, Chief Information Officer and Head of Product, said the results have been striking. On every metric the company uses — unique visitors, searches, total visitors, etc. — “those numbers significantly increased,” he said, and on an order of “20, 30, 40, 50 percent.”

Iannuzzi said that even accounting for the increase in job seekers created by the economic situation, the numbers are impressive. In the U.S. for instance, job searches rose 71 percent after the launch on Jan. 10., he said. In Germany, unique visitors rose 29 percent.

More launches are coming. On May 16th Monster will roll out its Trovix-enhanced search to a select group of 150 customers. They’ll use the new system for several weeks providing feedback and suggestions before the new search backend becomes standard toward the end of the year. A seeker side rollout is planned for late summer. Monster acquired Trovix last year.

By then we should see if Iannuzzi’s sense of optimism was well placed. Though he repeatedly cautioned that it could be nothing but a mirage, Iannuzzi said sales reps are reporting a greater willingness by customers to commit to long term contracts. “Don’t read too much into it,” Iannuzzi warned. But, he said there seems to be “a general sense of increasing optimism” and “not the doom and gloom we were hearing in Q4.”

Other Companies

SuccessFactors also issued its earnings report Thursday. It lost $5.7 million on revenues of $35.2 million. That’s a world of improvement over the same quarter in 2008 when it lost $19.1 million on revenue of $23.5 million.

“Q1 was a challenging quarter for SuccessFactors, as businesses of all sizes and industries slowed their decision-making and reduced spending on software products and services,” said CEO Lars Dalgaard. “We view this economic environment as an appropriate time to increase our focus on expense management and profitability, while continuing to invest in the highest levels of product quality, support, and total value for our customers.”

In the 2nd quarter, the company expects revenue to be in the range of approximately $35.5 million to $35.75 million. For the year, the company says it expects revenue of $145 million to $146 million, which would give it about a 30 percent annual growth.

Taleo, which had delayed filing its financial reports for 2008, finally did Thursday. Taleo reported revenue of $168.4 million and a loss of $8.2 million or 30 cents a share for the year. In 2007, the company earned $3.8 million on revenue of $128.1 million. It won’t report its first quarter numbers until next week.

Kenexa, another leading HCM vendor, won’t report its results until May 11th. Analysts expect it to report earning about 14 cents a share on revenue of $30 million.