Now that the drama queens in Washington seem (see “It ain’t over till it’s over”) to have reached a debt-ceiling compromise we can get back to the other big issue: job growth.

Now that the drama queens in Washington seem (see “It ain’t over till it’s over”) to have reached a debt-ceiling compromise we can get back to the other big issue: job growth.

This is the week when the U.S. Department of Labor reports its monthly employment numbers. Against a backdrop of slowing manufacturing, declining consumer job hopes, and other signs of a financial stall, economists are not holding out much hope that Friday’s report will be anything to celebrate.

A Bloomberg News survey of 62 economists found they expected, on average, that unemployment will remain at 9.2 percent and that 100,000 jobs will have been added to the economy. That would certainly be an improvement over June’s 18,000 jobs, but no where near the 250,000 to 300,000 needed to put a dent in the unemployment rate.

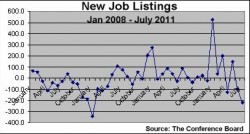

Meanwhile, a report from The Conference Board this morning offers no hope that August will be better. New job openings advertised online in July fell by an astounding 217,000 listings. It’s the biggest decline since January 2009, when 346,000 fewer listings were online.

To get your arms around what the number means, consider that through June, there were a total of 689,000 new job postings this year. July’s drop wiped out a third of the gains. The other consideration is that help-wanted ads suggest a slow August, since ads are run in advance of the actual hiring.

One more thing: While there is always a summer slowdown in recruitment, the last time The Conference Board’s Help Wanted OnLine Data Series showed a July decline in new ads was back in 2008, and then it was down by a mere 30,000 listings.

Wall Street, meanwhile, which said “Hooray” at the market opening over the debt ceiling compromise, immediately shifted its attention back to the economy and dropped into negative territory.

Offsetting the early enthusiasm, the monthly manufacturing index from the Institute for Supply Management came in this morning at 50.9 percent for July, down 4.4 points from June. Economists were expecting a much smaller decline, to 55 or 54.9.

On top of the news last week that the U.S. economy barely grew in the 2nd quarter — GDP came in at 1.3 percent vs. the still-gloomy 1.8- 2 percent prediction — economists sounded downright pessimistic in their comments to the business press.

“It’s definitely bad. On the badness scale, a 10 being an unmitigated disaster, I’d probably make this a six,” said Joseph LaVorgna, chief U.S. economist at Deutsche Bank, talking to CNBC.

Morgan Stanley economist David Greenlaw told The Wall Street Journal that the reports are giving him concern about the prevailing opinion among economists that growth will accelerate in this second half of the year.

Oddly, the Conference Board’s Consumer Confidence Index rose in July to 59.5 from 57.6. Because the survey period ended mid-month, consumers were probably not reacting as strongly then to the Congressional wrangling over debt and budget cutting. Still, they did say that current business conditions were weaker in July than in June and 44.1 percent said jobs were hard to get, up 43.2 percent in June.

The Thomson Reuters/University of Michigan Surveys of Consumers found much more pessimism in July. Its Index of Consumer Sentiment fell almost eight points to 63.7, the lowest level since early 2009. By two to one consumers expect the unemployment rate to rise, while 80 percent don’t expect any personal financial improvement this year.

Those results are consistent with a Harris Poll which found 78 percent of the American public believes the economy will either stay the same or get worse as the year progresses. There was agreement on jobs; 64 percent of the respondents in the poll said the job market where they live is bad. Only 22 percent expect it will get better in the next six months. The rest say it will stay the same (53 percent) or it will get worse (25 percent).

Wednesday, we’ll get an early hint of July’s job picture when payroll processor ADP releases its report on private sector job growth. Derived from ADP’s payroll data in conjunction with Macroeconomic Advisers, the National Employment Report is often criticized as an unreliable harbinger of what the official Labor Department report will show when it gets released on the following Friday.

The reports rarely sync up. Nevertheless, the ADP report is closely watched by the financial markets, which can gain or lose based on the numbers.