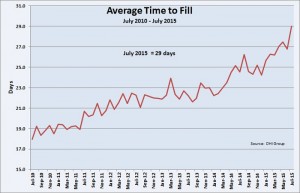

The time it takes to fill a job grew again in July, clocking in at 29 days.

The time it takes to fill a job grew again in July, clocking in at 29 days.

The DHI-DFH Mean Vacancy Duration Measure, sponsored by DHI Group, publisher of niche career sites including the tech site, Dice.com, said the national average time to fill is now the longest its been at any time in the last 15 years. Since July of 2014, the average has increased by 4 and a half days, and is 2 days more than in June.

Some jobs are harder to fill than others, according to the vacancy measure. At an average of 48 days, healthcare jobs take the longest to fill. Construction jobs fill in the shortest time – 11.9 days on average.

“Longer vacancy durations and falling unemployment rates point to a considerable tightening of labor markets in recent months,” said Dr. Steven Davis, an economics professor at the University of Chicago and co-creator of the measure. “Wage pressures are likely to intensify if the economy continues along this path.”

It also means that companies will be more likely to turn to outsider agencies for help filling jobs, especially since turnover is rising even as they expand their workforce.

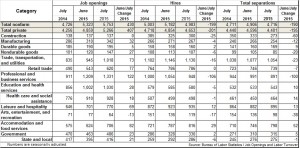

The Bureau of Labor Statistics said job openings reached an all-time high in July, with almost 5.8 million government and private sector vacancies at the end of the month. That’s an increase of a million open jobs over the count in July of 2014.

Private sector job openings accounted for 5.3 million of the total, more than a million openings more than the year before. (The numbers are seasonally adjusted.)

Meanwhile, the rising number of openings, and improving consumer confidence, among other positive economic indicators have emboldened workers. They’re quitting their jobs in increasing numbers. The BLS, in its monthly JOLTS report, said 2.5 million private sector workers voluntarily quit their job in July. That equates to a rate of 2.1% of all private sector workers. And to an annual rate of about 26%, meaning that just over a quarter of the workforce, on average, will voluntarily quit this year.

The BLS calculated the quits rate at 24.6 percent last year and 22.8 percent in 2013. (The BLS uses unadjusted numbers to calculate the annual rate.)

Employers made 4.6 million hires in July, the most recent month for which data is available. Between the openings and the hires, the shortfall amounted to about 800,000 vacancies during the month.

Although the BLS counts mostly external hires (transfers from one site to another are included) and open jobs are those with active recruiting, attempting to mesh all the numbers is at best inexact. However, the broader picture is of an increasingly more difficult recruiting environment.

Adding to that picture is Tuesday’s release by The Conference Board of its Employment Trends Index. Heading up since bottoming out at 91.24 in July 2009, the Index logged in at 128.82 in August. That’s not far off it’s highest reading of 131.94 registered back in July 2000.

““The large increase in the Employment Trends Index in August suggests that a significant moderation in employment growth is unlikely to occur in the coming months,” said Gad Levanon, managing director of Macroeconomic and Labor Market Research at The Conference Board. “With solid job growth expected to continue, the unemployment rate is likely to go below 5 percent by year’s end.”

The Index is a particularly useful measure of employment trends. It aggregates eight labor indicators including the BLS’ job openings report, unemployment claims filings, temp hiring, and the Fed’s industrial production report.