When I’m not doing my day-to-day TA job, I spend a lot of my remaining time having wonderful conversations with TA professionals around the world — discussing challenges, opportunities, and forward-looking ideas. Through the course of these conversations, I’m often struck by how few TA organizations are informing their decision-making and organizational structure based on the differentiated nature of their own workforce.

What a Differentiated Workforce Is and Why It Matters

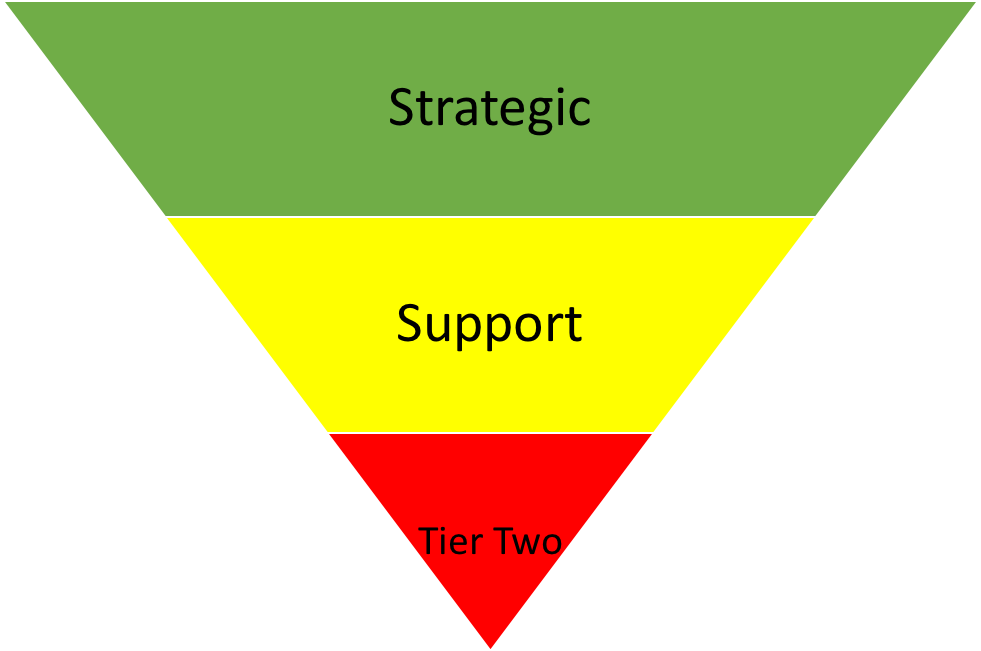

The simplified answer is that in any workforce, there are roles that produce more value than others. In the book The Differentiated Workforce, the authors define three types of roles that they feel cover the vast majority of organizations: Strategic, Support, and Surplus (personal note: I am not a fan of the term “surplus” and personally use “Tier 2 Support” instead).

Strategic roles have direct and significant revenue generations or develop the strategy or technology to enable revenue generation. Support roles directly enable the strategic roles, and Tier 2 Support roles provide necessary service to the company, but do not necessarily enable revenue generation. As an example, in many organizations, Commercial Sales is most likely a Strategic role, talent acquisition is a Support role, and Custodial Services is a Tier 2 Support role.

Another key way to gauge where a role falls is to measure the outcome of differentiated performance. Using the example above, there is a broad outcome difference as measured by financial results (example: shareholder value) between top-, middle-, and bottom-performing Commercial Sales professionals, there are modest differences in impact to the same in the support roles, and negligible differences resulting in performance differences for Tier 2 roles.

Interestingly enough, the nature of these roles is often disproportionate to number of roles, meaning there are far fewer Strategic roles (and therefore often hires) than there are Tier Two Support. (See graphic above.)

For most organizations it will look similar to the pyramid above. Additionally, in the vast majority of cases, there is also alignment between barrier to entry and candidate availability. Generally Strategic positions have significant barriers to entry, such as education and experience. These tend to be protected and well-cared-for employees, as their employer generally recognizes their disproportionate value, and as such there will be small and challenging candidate pools for these roles. Support roles generally have a moderate barrier to entry, and have larger candidate pools than Strategic roles and are somewhat less of a challenge to crack. Tier 2 roles generally have a very low barrier to entry, and a very wide and plentiful candidate pool.

This model should then inform your effort and energy by way of recruiting, and should look something like this.

However, for most organizations, it does not, and effort and energy follows volume, instead of impact.

This isn’t particularly surprising, since most TA folks I talk to tell me they are measured on number of fills and time to fill. This is instead, of course, quality (non-tenure driven, but results driven), and impact, which are more telling and better measures. So, even if the wrong model is being driven from above, the TA team is left holding the bag as being non-strategic and non-value add.

Therefore it is critical that you drive flipping and properly aligning the effort. The logic should be self evident and allow you to build the necessary case.

Let’s look at process and people.

From a process stand point, I’ll use the model I’ve used at a high number of rodeos.

Let’s start with Tier Two roles. It is best to have this group of roles your team is recruiting for to be populated by positions that you can manage as a transactional process. Since the barrier to entry is so low and the candidates are more plentiful, these are the positions you post for and candidates are active and apply. The level of assessment from the recruiter is minimal (again, almost no differentiation on impact between top and bottom performers), and that assessment process can almost always be entirely automated. Close rates for the recruiter matters less in these roles based on the volume of qualified candidates. This should represent the lowest dollars per hire invested from your budget.

Support roles are sort of a mixed bag and intermediary in process between Strategic and Tier 2. Some roles will have active candidates; some you will need to do some more leg work on to recruit. From an assessment standpoint, there is moderate differentiation between performance and outcomes. Closing becomes more important, since there are fewer qualified candidates in your pool.

Strategic roles are by nature very tough to recruit for. Postings will have near zero effectiveness. Direct sourcing and advanced pipelining is where your efforts need to be. The ability to assess candidates is critical here, as the performance to outcome ratio is at its most significant, and you have to be at the top of your closing game here too, for obvious reasons. This should represent the highest spending per hire of your budget.

Knowing this, you can then structure you team accordingly to be the most efficient and effective. So let’s look at people and organization.

Tier 2 roles, being transactional, allow for recruiters to carry a higher volume. In my experience if the roles are both transactional and high volume, I will set the req load as high as 50. This is where I will start new recruiters, to begin to expose them to recruiting, candidate, and manager relations. Also, since they tend to be new in general, it is not as important that they have the full financial and business acumen I require (i.e.: my team needs to be able to clearly articulate “how” we make money as a company) … it gives them time to learn.

Support roles require a higher skill level from my recruiters, and a higher effort level. I have found that the tipping point for effectiveness for these recruiters is between 14 and 20 requisitions. They have to have more advanced candidate and manager relation skills, better closing skills, the ability to work more independently, etc. This is in most cases my 3+ year experienced recruiter(s).

Strategic roles as noted above are the tough roles. They require massive effort, and high skills. In most cases I limit recruiters to five open reqs (trust me, the value to the company is there!), as they will spend more time recruiting, assessing, and white-gloving a candidate. Their success or failure has a massive effect on overall company performance. Clearly, these are my senior recruiters. Seasoned, experienced, and consummate closers!

This model, as opposed to assigning recruiters roles based on business line and giving them a mix of strategic, support, and Tier Two roles to try and manage, has the added bonus of allowing you to be flexible and scalable. You have created an algebraic equation to use to scale up or scale down as needed!

If you have questions or need more clarification, please comment below and let me know. I want to do my part in enabling TA pros to be successful and engaged!