U.S. firms are shifting away from hiring full-time, permanent workers, as worries over the fragility of the economy and the looming implementation of the national healthcare program cause CFOs to bring on temps and part-timers when workers are needed.

U.S. firms are shifting away from hiring full-time, permanent workers, as worries over the fragility of the economy and the looming implementation of the national healthcare program cause CFOs to bring on temps and part-timers when workers are needed.

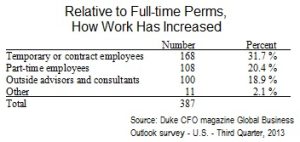

The quarterly Duke University/CFO Magazine Global Business Outlook Survey found 59% of CFOs have increased temporary and part-time workers and are turning with greater frequency to outside consultants and advisers. The survey shows work increased:

- 31.7% for temp or contract workers;

- 20.4% for part-timers;

- 18.9% for outside consultants and advisers.

As it has for 18 years, Duke surveyed CFOs globally about their view of economic conditions nationally and at their own company. The results show the emotional impact of the recession lingers on, keeping CFOs wary about spending, especially on hiring, even as they are more optimistic about their company’s financial health.

In the U.S., the 530 CFOs say they expect profits to rise an average of 10%, and overall headcount to increase 2%.

“The expected 2% growth in employment is solid, given the context of long-run shifts away from full-time employees largely because of concerns about health care reform and economic uncertainty” said John Graham, Duke Fuqua School of Business finance professor and director of the survey. “Another trend that is affecting the growth in domestic employment is the hiring by U.S.-based companies of full-time employees in foreign countries. More than one-in-four U.S. CFOs say their firms have hired full-time employees in other countries, and that number is expected to accelerate.”

Economic uncertainty was cited by 44.3% as the reason for not hiring permanent full-timers. The new healthcare law was cited by 38%, while 24% said salary considerations kept them from full time hiring.

Though outsourced employment will grow 3%, significantly faster than other types of workers, full-time headcount is expected to increase 1.8% over the next 12 months. That’s only somewhat more than the 1.5% growth they expected in the September 2012 survey.

At least some of those full timers will be added internationally. Of the 28% of companies with foreign workers, almost three-in-four expect to add workers, with the majority of them adding at least as many overseas as in the U.S.

Temp hiring is expected by the CFOs to grow only .8%.

Cautious about hiring, CFOs are much more optimistic about their earnings growth. With revenues expected to increase on average 5.7%, CFOs at the public firms participating in the survey expect, on average, a 13.4% increase in earnings.

Compared to the September 2012 survey, the CFOs say they expect to spend more on captial purchases (4.8% increase vs. 3.7%); less on R&D; more on advertising and marketing; and the same on IT.