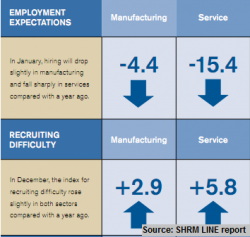

You don’t even have to read the text to know that SHRM’s LINE report has bad news this month. The plus and minus signs say recruiting is getting more difficult while the number of new reqs is going down.

You don’t even have to read the text to know that SHRM’s LINE report has bad news this month. The plus and minus signs say recruiting is getting more difficult while the number of new reqs is going down.

The gloomy January outlook says, “For the third consecutive month, hiring activity will decrease and job cuts will rise in the manufacturing and service sectors compared with a year earlier.”

Now click over to The Conference Board and you find that every arrow on its list of U.S. indicators is up. Yesterday, The Conference Board said its Employment Trend Index rose in December for the third consecutive month. This morning, the non-profit business organization released its CEO Confidence measure for the last quarter of 2011. It was up seven points, coming in at 49, just one point below where it turns more positive than negative.

So who’s right and who’s wrong?

Probably no one or everyone. Or at least everyone is partially right. This U.S. recovery, such as it is, is tentative, slow, and unlike those that followed most of the country’s previous recessions.

A few months ago, Federal Reserve Chairman Ben Bernanke warned, “While we still expect that economic activity and labor market conditions will improve gradually over time, the pace of progress is likely to be frustratingly slow.”

A few months ago, Federal Reserve Chairman Ben Bernanke warned, “While we still expect that economic activity and labor market conditions will improve gradually over time, the pace of progress is likely to be frustratingly slow.”

“Moreover,” he added, “There are significant downside risks to the economic outlook.”

That economic reports will seesaw on a monthly basis is therefore not surprising. It happened at the beginning of last year when unemployment went from 9.8 percent in November 2010 to 9.4, then 9.1 and to 8.9 percent in March 2011. January’s job growth was 68,000, jumping to 235,000 in February, before dropping like a rock in May, along with the stock market.

As those job numbers grew and unemployment declined, consumer confidence rose, as did several other economic indicators, including The Conference Board’s Employment Trend Index. By May, it all stalled out and some indicators — Consumer Confidence among them — went into decline.

Last month was a bullish month, with the U.S. economy adding 200,000 jobs. It echoed a similarly bullish 152,000 jobs added in December 2010. But that was followed a month later by 68,000 in January. Now the question is, will 2012 repeat 2011. SHRM’s Leading Indicators of National Employment survey is saying January will.

Every month the Society for Human Resource Management surveys HR executives about their hiring plans for the month ahead, as well as their difficulty in recruiting, vacancies, and new hire compensation. The results, broken out for manufacturing and the service sector, are released at the start of the new month and offer an preview of what may happen.

“The LINE results for January 2012 reflect an ongoing trend of subpar growth in job creation,” says SHRM. The key findings from the report predict:

- Low rate of job creation expected for January.

Hiring activity will fall slightly in manufacturing and sharply in services in January compared with a year ago. - Recruiting difficulty edges up in both sectors.

More HR professionals in both sectors reported increased difficulty with recruiting key candidates in December compared with a year ago. - Some new hires see increases in compensation. In December, the rate of increase for wages and benefits

rose on an annual basis in manufacturing and fell in services.

If you, like countless other Americans, wonder why the recovery isn’t recovering more quickly, Prof. Stephen P. A. Brown at the University of Nevada Las Vegas offers an explanation. He’s director of the school’s Center for Business and Economic Research, and he says this recovery is different from those that preceeded it because the recession was different.

In “Why Such a Slow Recovery of the U.S. Economy?” Brown says, “Unlike the previous 10 post?World War II recessions that the United States endured, the 2007?09 downturn was precipitated by a financial crisis … financial crises tend to lead to recessions that are more severe and recoveries that are substantially slower. In some cases, the crisis may affect economic growth for as much as a decade after the recession’s official end.”

His prediction for the months head?

… employment will grow only fast enough to maintain U.S. unemployment rates in the current range around 9 percent for a sustained period of time. A complete recovery in which economic activity rises to its potential and the unemployment rate is reduced will take a much longer period of time and considerable readjustment in the economy.