After a so-so end to a so-so year, Monster executives are pinning their hopes for a company makeover on a lineup of new products, some to be introduced in the next few months, others launched last year and a few legacy tools like Power Resume Search.

After a so-so end to a so-so year, Monster executives are pinning their hopes for a company makeover on a lineup of new products, some to be introduced in the next few months, others launched last year and a few legacy tools like Power Resume Search.

“We’re building a new Monster,” COO Mark Stoever, declared during a conference call with analysts this morning.

In optimistic, if subdued language, he and President and CEO Tim Yates, discussed the company’s fortunes as they detailed the product portfolio they maintain will again make Monster a major player in recruitment sourcing.

The company’s year-end financial report out this morning suggests it has mileage to make up. Monster earned 7 cents a share in the last quarter of 2014, after excluding certain one-time expenses, including a $326 million charge against goodwill. The per share earning was a penny above Wall Street’s forecast.

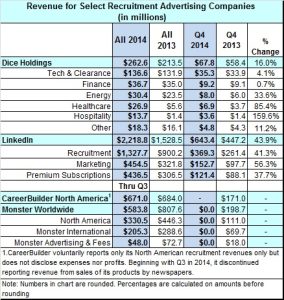

On the other hand, at $186.2 million, revenue was down 6.3% from the same quarter in 2013, coming in 3.3% below analyst expectations. For the full year, Monster saw its revenue decline 4.7%, bringing in $770 million, which was just a bit more than a third of what high-flying LinkedIn reported last week.

The market responded to the earnings beat — and company plans to layoff some 300 workers to save up to $45 million annually — by bidding up the stock price 10.5 percent by midday, before settling back to about 8%.

Some part of the decline over last year can be attributed to a weakening Euro; some to persistent employment softness in Europe, where bookings, a measure of annual contract signings, was off. Less easily explained is the quarterly revenue decline in North America. In comparison, publicly held Dice Holdings, a much smaller operator of niche career sites, has posted quarterly gains for the last two years. The bulk of its revenue comes from American operations.

Meanwhile CareerBuilder, privately held by a group of newspapers, said its North American revenue came in at $162 million, up 2% from the year before. A direct comparison with data previously provided ERE by CareerBuilder is not possible because the company has changed what it discloses.

Meanwhile CareerBuilder, privately held by a group of newspapers, said its North American revenue came in at $162 million, up 2% from the year before. A direct comparison with data previously provided ERE by CareerBuilder is not possible because the company has changed what it discloses.

Another indicator of Monster’s woes was the goodwill write down. Multiple intangible components go into accounting for goodwill, including the value of the brand and customer loyalty. When these decline, public companies take an impairment charged against income. More symbolic than anything else, Monster calculated the goodwill value of its North American careers sector declined $263 million. The balance was charged to its advertising and fees group.

During the conference call and in the company’s written statement, Yates insisted that the goodwill charge “in no way reflects a lack of confidence in our strategy.” Unveiled last year by former Chairman, President and CEO Sal Iannuzzi who resigned last fall, theso-called three pillars strategy is an assortment of tactics pioneered by other sites. These include aggregating jobs from all over the web, implementing a portfolio sourcing service developed by Talent Bin, which Monster owns, and providing a variety of sourcing and CRM tools.

Now branded as “All the People, All the Jobs,” the various pieces are still being rolled out, but, said Yates, the new products are gaining traction with customers who try them.

“Clients like the new products,” he said, using Manpower as an example. The giant staffing firm has had good success with targeted Twitter Cards, and is a beta tester of the forthcoming Social Ads product. That’s to be rolled out generally in the next few months.

Social Ads is a product designed to get jobs in front of a highly targeted audience that is present mostly on social media sites. Briefly discussing the product with me in a later call Stoever called it a “net gen” tool that “allows us to leverage data that is proprietary to us.”

Now on Twitter, Stoever said its reach will include other social media, which ones, he didn’t say. However, he said it’s different from what Facebook and LinkedIn offer.

Also to be launched later this quarter or early next is a pay per click service, specifically for small and mid-sized businesses. Similar in concept to what Indeed and SimplyHired offer, it will enable businesses to improve the positioning of their ads on Monster’s emerging jobs aggregation service, paying only for the clicks the ads receive.