This morning’s report from ADP said the U.S. economy added 209,000 private sector jobs last month, adding to the growing confidence in the steady, if slow improvement in conditions.

This morning’s report from ADP said the U.S. economy added 209,000 private sector jobs last month, adding to the growing confidence in the steady, if slow improvement in conditions.

However, the numbers didn’t do much to help stocks, which was down some 155 points in early afternoon trading in New York. Investors worried over comments by the Federal Reserve saying new stimulus programs were unlikely, at least in the near term. Exacerbating their concerns were signals from Europe suggesting new problems in the Euro zone.

Even the ADP numbers, though positive, were seen as not offering much hope of a strong March report from the U.S. Department of Labor, when the official numbers are released Friday morning.

Derived from the average 344,000 payrolls ADP processes each month, the March number of new positions came in above the average of what economists expected. Bloomberg’s survey put the number at 206,000; Reuters had it at 200,000.

ADP and its partner in the monthly jobs estimates, Macroeconomic Advisers, also upped the numbers for both December and January. January’s numbers increased by 9,000 to 182,000, and February increased 14,000 to 230,000.

Joel Prakken, chairman of Macroeconomic Advisers, said, “The March increase in private employment suggests that the national unemployment rate may have declined slightly last month. It would also be consistent with other indicators suggesting some firming of labor market conditions, such as the downward trend in unemployment claims and upturns in the components of consumer sentiment and confidence influenced by perceptions about the availability of jobs.”

Despite his cautious optimism, economists don’t expect to see a decline in unemployment when the U.S. Labor Department issues its monthly jobs report Friday morning. Reuters’ survey says economists expect no change in February’s 8.3 percent unemployment rate, while the jobs gain was put at 203,000.

Offsetting the optimism that would normally have accompanied a better-than-expected ADP report was another from the Institute for Supply Management. Its services index fell to 56.0 from 57.3 in February. Economists had predicted a slight drop to 57.0.

“We think it’s consistent with the current tone of economic activity and points to growth of about two percent,” said Millan Mulraine, senior macro strategist at TD Securities in New York.

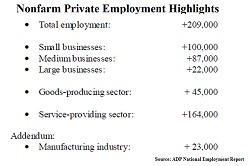

The services sector accounts for about two-thirds of U.S. economic activity. In the ADP report, the services sector added 164,000 jobs in March. That was 19,000 fewer than in February and only 8,000 above January, a month when retailers lay off their seasonal help.

Small businesses — those with fewer than 50 employees — accounted for 100,000 of the added jobs. Employers with more than 500 workers added 22,000 jobs. Manufacturers added 23,000 positions.

The Conference Board’s monthly count of online job postings showed an increase in March of 246,300. It’s the largest jump in more than a year.