![]() Surprising economists and delighting Wall Street, the U.S. unemployment rate dropped in July as the U.S. Bureau of Labor Statistics reported a significantly lower than expected job loss during the month.

Surprising economists and delighting Wall Street, the U.S. unemployment rate dropped in July as the U.S. Bureau of Labor Statistics reported a significantly lower than expected job loss during the month.

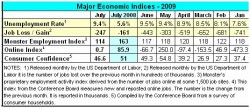

Instead of the 275,000 to 325,000 jobs that economists in two respected surveys thought were lost in July, the BLS said the number was closer to 247,000. The BLS report also put the July unemployment rate at 9.4 percent, a .1 drop from June. Economists had been expecting a rise to between 9.6 and 9.7 percent.

The drop in the unemployment rate was the first since April 2008 and the job loss was the smallest since August. The news sent stocks higher today. The Dow was up almost 136 points at midday.

While the numbers are welcome news to a recession-weary country, they are not evidence of a recovery. Job counts, layoffs, and hiring — cumulatively the employment situation — are all considered lagging indicators. In a slowing economy, companies take other steps to cut expenses before laying off workers. Likewise, when business begins to pick up, companies restore lost hours and pay overtime before making new hires, just in case the economic improvement is a blip, rather than a full-fledged trend.

There is tentative evidence in the BLS report that this is happening. The government said the average workweek for production and nonsupervisory workers was up .1 hours while the workweek for the manufacturing sector was up .3 hours. Factory jobs, which had been disappearing at a clip faster than most other sectors, were down by 52,000, the smallest decline in a year, and about half the 100,000 that had been expected. Since the recession began, 2 million factory jobs — the majority in automotive — have been lost.

Construction jobs also had a big decline, but the 76,000 lost jobs was less than the 117,000 that were lost on average each month from November through April.

However, there’s also plenty of evidence pointing to just how tentative and slight the improvement is. The Conference Board’s Consumer Confidence Index dropped in July for the second month in a row. It’s still above the recession bottom of 27.3 in February, but two months of declines suggests the public is not convinced a recovery is afoot.

However, there’s also plenty of evidence pointing to just how tentative and slight the improvement is. The Conference Board’s Consumer Confidence Index dropped in July for the second month in a row. It’s still above the recession bottom of 27.3 in February, but two months of declines suggests the public is not convinced a recovery is afoot.

The decline in the unemployment rate isn’t necessarily reflective of any significant pickup in unemployed workers finding jobs. The BLS report says 2.3 million Americans were marginally attached to the workforce, meaning they had looked for work in the past 12 months but aren’t counted as unemployed because they didn’t search for work in the four weeks prior to the BLS’s monthly survey.

If these workers, often called discouraged workers, and the workers who settled for part-time employment because they couldn’t find full-time jobs were added to the unemployment count, the rate would be 16.3 percent.

Both the Monster Index and The Conference Board’s Help Wanted Online Index offer little encouragement about the job situation. The Conference Board’s count of the number of jobs posted online was virtually unchanged from June, when 3.3 million job postings were counted. The Monster Index, meanwhile, was down to its lowest point since 2004. In both instances, the seasonal summer decline in job activity may be to blame.

“The decline in U.S. online recruitment activity at the beginning of the third quarter is likely due to a seasonal summer slowdown that is typical this time of year, with most industry and occupational categories experiencing reduced demand,” explains Jesse Harriott, senior vice president and chief knowledge officer at Monster Worldwide. “Although the Index is down 27 percent year-on-year, an encouraging take-away and potential sign of stability is the fact that the Index is now showing its most moderate pace of annual contraction since February.”

Even the White House was cautious about today’s unemployment numbers. Press Secretary Robert Gibbs said, “We are pleased, but not satisfied that the rate of that job loss is declining,” adding, “Without seeing some genuine, positive, sustained job growth, you’ll likely to see the rate continue to go up.”