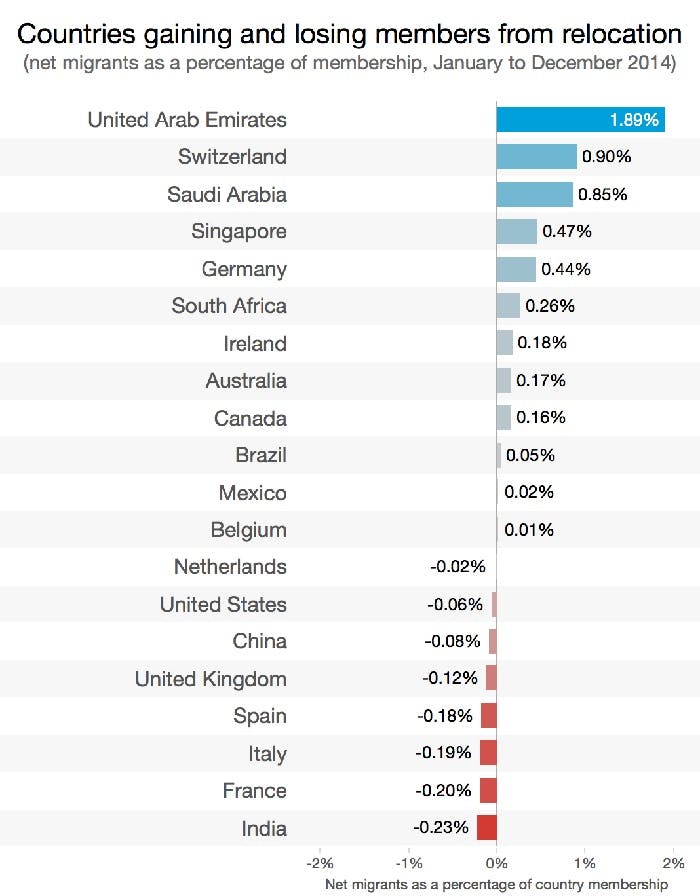

Out this morning from LinkedIn is an interesting bit of data about the global migration of its members.

Of the top 20 countries that saw members move across their national boundaries last year, the United Arab Emirates was the biggest gainer percentage wise. According to the blog post from LI’s Insights Group, the UAE saw a net in-migration that worked out to 1.89 percent of its LI membership. India lost 0.23 percent of its LI members to other countries, principally the U.S. where nearly 40 percent of its economic emigres went.

It was the second consecutive year the UAE came out on top. In 2013 it saw a net in-migration equal to 1.3 percent of its LI membership.

The U.S. in 2013 and again this year had a net loss. In 2013 it was 0.1 percent. This year it was 0.06 percent.

What’s the significance? Before I get to that, a few more details:

- Of those relocating to the UAE, the majority were salespeople, marketing specialists, project managers, corporate finance specialists, accountants, consultants, and mechanical engineers working for professional services, technology, financial services, and engineering firms.

- Technology, says LinkedIn, was the impetus for India’s talent loss. Software engineers, consultants, project managers, salespeople, and graduate research assistants made up more than a quarter of all members who left in 2014. Nearly half worked for tech firms.

What’s a recruiter to make of this? If you place in any of the niches in demand in the UAE, you might want to make sure you talk to your candidates about opportunities there. India may be the single biggest source of talent for the UAE, but LinkedIn says the U.S. and UK are among the top five.

It’s also useful to get some sense of the actual numbers. Losing 0.06 percent of the U.S. membership to other countries doesn’t sound like much, but translating that into workers, it’s something like 70,800. Doing the same calculation for the UAE, we get a net gain of about 18,900.

At best, these numbers are approximations. The country counts I used are generalizations, but it does offer a sense of the scale of the world’s worker migration; at least as seen through LinkedIn. The LinkedIn team listed its own caveats about the data, not the least of which is that not everyone is equally conscientious about updating their profile.

One other point: While this data may be more curiosity than business actionable, it’s a peek at the enormous amount of information that LinkedIn has to mine as part of its Economic Graph. And the data is still growing as LinkedIn continues to gain momentum around the world.

While it’s interesting to see the cross-border movement. It’s competitive business intelligence to know who the companies are that are bringing in the workers (or losing them) and the kinds of projects or roles these migrants are assigned. LinkedIn knows that. How valuable would it be to a search recruiter (not to mention to business analysts) to know who’s hiring, where and for what skills and in what numbers?

There are sources other than LinkedIn for some of that. CareerBuilder’s Supply and Demand product has some. Wanted Analytics is especially strong on the demand side. LinkedIn, though, has a unique window on what is happening now.