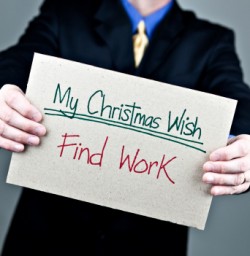

If you’re out shopping today, there’s a good chance that the person helping you purchase your items or finding that deeply discounted item for you had a different, permanent job last year.

If you’re out shopping today, there’s a good chance that the person helping you purchase your items or finding that deeply discounted item for you had a different, permanent job last year.

Even if you avoid all forms of in-person commerce in between Thanksgiving and New Years, like me, it is likely that the person fulfilling your order at an online retailer is in the same boat.

Temporary staffing has always been a mainstay of the holiday shopping experience. The convergence between the traditional holiday staffing issues, consumer behavior, and corporate balance sheets continues to leave many baffled about what 2011 and beyond holds for employment in this country.

Holiday Hiring Is Up

There is at least a bit of good news coming off some continued flatness in unemployment: holiday hiring is up. Big time. SnagAJob.com, the job board for hourly workers, estimates an increase of 26 percent over last year. Employment firm Challenger, Gray & Christmas estimate the increase at about 20 percent. Retailers are expecting sales gains to outpace last year.

On the surface, this is great news. Stronger retailing points (at least superficially) to better economic conditions. As the Wall Street Journal points out, there is good news for those who are hoping a seasonal or temp position will help secure something a bit more stable:

“The hope of landing a permanent position is one reason people are willing to turn their lives upside down for a temp job; 40 percent of employers that are hiring seasonal workers this fall intend to offer some of them permanent jobs, up from 31 percent last year, according to a survey of 2,457 employers by CareerBuilder, Chicago, operator of a job-search web site.”

Meanwhile, temporary payrolls continued their steady growth in September and October while the rest of the employment picture continues its stop-and-go progress.

But now there is a new challenge.

The Changing Consumer

As retailers adapt to shifting consumer behavior, the impact on the workforce is unavoidable. Look at what retailer Toys “R” Us is doing to respond, according to The Courier-News (Elgin, Illinois):

“Toys “R” Us spokeswoman Linda DeNotaris said that with so much of the toy business happening at Christmas time, the company experimented with the temporary, 4,000-square-foot “pop-up” Express stores last holiday season in 90 locations.

Customers responded so well to those added locations that this year, the chain is opening 600 Express stores, more than six times as many as last year and about equal to the number of regular Toys “R” Us stores in operation. And these pop-up stores will require 10,000 new seasonal workers to staff them, DeNotaris said.

Opening up, stocking, operating for a couple months and then closing these stores down is more economical than running the operation year ’round. If the trend takes hold, that means retailers will continue to shed full-time workers for either part-timers or seasonal workers.

Analysis is mixed as to whether this is a permanent consumer change or whether it is a continued reaction to the ongoing recession, but by any estimation, it will continue to at least be a short-term concern. As the economy slowly grows back though, pressure will be on retailers from Wall Street to respond immediately and with strong competition still in place, will be a challenge for retailers to not adapt.

Companies Continue to Hoard Money

The larger concern is what companies choose to do with the massive amounts of cash they have in the bank. While not as publicized as the retail market and not as obvious, it is the 800-pound gorilla in the room when talking about employment. To quote from the Baltimore Sun:

As of June 30, the non-bank members of Standard & Poor’s index of 500 big U.S. companies were sitting on $842 billion in cash, according to Howard Silverblatt, senior analyst at S&P. Count all U.S. companies, and it’s well over $1 trillion, according to the Federal Reserve.

That was the seventh quarterly record in a row for S&P cash. The cash pile was also very high on a relative basis, making up nearly 12 percent of the market value of those companies. A decade ago, corporate cash was less than 3 percent of the S&P 500’s stock market value.

As we continue to slog through a rough economy, companies are sitting on a record amount of cash — some $1.1 trillion. And what they choose to do with it is going to have a huge impact on the employment picture in the U.S.

What’s Next?

I’m sure most people are tired of hearing about how we are going to have to wait until the next few quarters play out before we come to any conclusions, but I think in this case, it is perfectly appropriate. What we do know is:

- Part of the response hinges on how retailers do this holiday season. Anything at or above expectations is going to be seen positively whereas anything below expectations could be a huge blow.

- Consumer behaviors are certainly changed for the short term. Whether that impacts buying and investing in late 2011 is what is murky right now.

- Whether temp workers get converted to full-timers is going to depend largely on how companies choose to invest on hand cash. I have a feeling that stockholders and boards are going to start pushing investment once again in 2011.

- Could we be in store for another round of merger and acquisition activity? That’s certainly another option for that cash on hand besides hiring employees. And in certain depressed sectors, it might make more sense than bringing on new employees.

What’s your take on this? Is the workplace shifting or is our economy just taking longer than usual to recover?