If you haven’t already, take some time now to reflect on your financial performance as compared to the budget you created at the beginning of the year. Budgets are the compass for our business. They allow us to guide ourselves to success and prosperity. This mid-year review is the process of becoming “aware” of where you truly are in the execution of your plan.

To begin, we need to make sure our books are complete. Make sure all outstanding invoices are paid and properly recorded. If you use an outside accounting or bookkeeping firm they can help with this process.

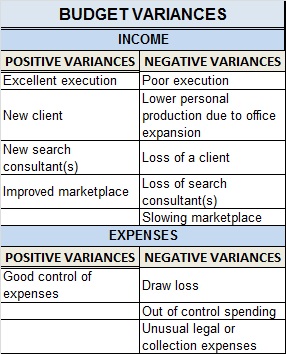

Now that you have the results of January through June, compare your actual results to the budget and create a column of variances. You should also compare actual results from this six month period to the same six month period last year. Some  variances will be positive and some negative. For those variances which are significantly different from the budget and/or last year, you will want to spend time analyzing why. Understanding variances will provide clarity on how your business is really doing. Some things to focus on are listed in the chart.

variances will be positive and some negative. For those variances which are significantly different from the budget and/or last year, you will want to spend time analyzing why. Understanding variances will provide clarity on how your business is really doing. Some things to focus on are listed in the chart.

Now that you know the good and the bad, develop an action plan. This is your vision of how your company will operate for the remainder of 2015 and will provide a blueprint on how to begin to build the foundation for 2016. For example, bringing on new recruiters next and getting them trained and productive takes time. Training is a process. That’s something to do now, not next January.

Review Your Balance Sheet

At this time I would also recommended reviewing your balance sheet. Most owners focus on income and expenses. A review of the balance sheet is critical to make sure you have the financial strength necessary to execute your plan. Day-to-day operations provide cash flow to operate; your balance sheet provides the ability to continue should your operations fail to produce cash flow for whatever reason.

I would also suggest it’s important for we owners to review not only our business financial condition, but also our personal condition as well. The review of the “total” financial condition must be analyzed for a satisfactory picture. For example, unusual personal expenditures could put pressure on the company to provide that necessary cash. For small business owners like us, the business and our personal situation become very much co-mingled.

Now, recommit to your budget and operations and remember to play to your strengths. Announce your intentions so that you truly own your budget. Put goals on an office wall for all to see and for you to monitor monthly. Truly owning your business plan will allow you to execute your plan. A well-executed plan will give you confidence and make your cash flow consistent, profitable and will make this business much more fun.