When change comes to recruiting, it comes in a variety of forms. In the search for the candidate who will deliver the best value for the money, companies are continuously innovating and seeking competitive advantage in the employment marketplace. Trends, fads, and idiosyncratic procedures are commonplace.

When change comes to recruiting, it comes in a variety of forms. In the search for the candidate who will deliver the best value for the money, companies are continuously innovating and seeking competitive advantage in the employment marketplace. Trends, fads, and idiosyncratic procedures are commonplace.

Again, change comes in a variety of forms:

- New technologies (like job boards or applicant tracking systems) can shift the relationship balance between employer and employee

- New techniques (like behavioral interviewing and Internet sourcing) can change the selection process

- New ways of doing business (like outsourcing) can change the volume and complexity of recruiting relationships

- Shifting economics can change the demand equations, making some skills more valuable than others

- Demographics can alter communications goals and processes

- New information management Ideas (like open source, wikis, or public resume databases) change the competitive intelligence aspects of the game

- Technology disruption can eradicate an industry, creating a surplus of potential employees who don’t quite fit

- Fads and voodoo (handwriting analysis is a popular assessment tool in some places) shape some companies perspective

There is a Darwinian process for figuring out which technologies work and which fail. The team that fields the best technology, marketing, and sales combination gets to fight the next battle. Market dominance is rarely evidence of product quality alone. It’s usually a blend of of a pretty good product, super marketing, and relentless sales that distinguishes the winners.

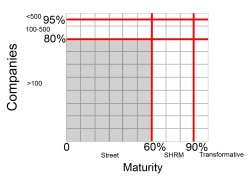

As we start to look at the ways in which recruiting might change, it’s important to have a shared perspective of the market. The following map is one way of looking at all of the possible recruiting entities in the domestic American economy. It’s a grid representing all of the establishments in the United States that hire people. There are about 7.5 million of them. (The number is somewhat smaller due to the downturn so I’ve used percentages.)

The vertical axis is marked at the 80 percent, and 95 percent points. Eighty percent of all companies have fewer than 100 employees; 15 percent have between 100 and 500 employees, and 5 percent have more than 500 employees. If you squinted, you could see the 1,800 companies with more than 5,000 employees. Each of these groups handles recruiting in relatively different ways.

The sub-100 crowd rarely uses formal systems to recruit. For many, it’s not really very likely that there’s an HR system much beyond payroll and benefits. Word of mouth and local referrals dominate the hiring process. This is one of the arenas in which Craigslist is very strong.

The sub-500 group is where formal systems start to matter. The recruiters are as likely to be an HR generalist as they are to be a competent professional recruiter. Much of the mom-and-pop contingent search business operates in this sector.

Above 500 employees begins to be enterprisey. As companies get larger, procurement processes become more formal, HR gains authority and credibility and IT infrastructure begins to be a serious investment. The squint level (5,000 and above) companies are a rarified environment.

The horizontal axis is marked at 60 percent and 90 percent.

The horizontal axis is marked at 60 percent and 90 percent.

Sixty percent of all companies (more or less) use reactive street-level HR structures that are designed to solve crises. Almost perfectly administrative, these operations are the holdouts from the era of the personnel department. HR is for payroll, absolute minimum regulatory compliance, time keeping, benefits administration, and old-fashioned hiring methods. The bottom-left-hand corner of the matrix is darkened for two reasons. First of all, this is where most job creation happens. Second, recruiting, as it is described in any sort of professional literature, basically doesn’t happen here. Hiring is done by word of mouth, local bulletin board advertising, Craigslist (maybe), and asking around (the low-level referral system).

Thirty percent of all companies have SHRM members. HR and Recruiting work hard to be proactive and strategic. This is the world where the HR person aspires to a seat at the table. In the sub-100 companies, recruiting is done by the executive team and HR means a good work environment and great benefits. For the smallest HR operations in this category, SHRM is the HR training department. Above 100, the HR department is earnest and hard working with a new found tendency to focus on measuring and improving their processes.

The final 10 percent on the horizontal axis are the places where the human capital function is transformative. The recruiting and other HR functions deliver business results and impact. They expect to be involved in executive decision-making and wonder what the all that fuss about the table is about. They do their work in the golf cart. In this segment, analytics is catching on and people are starting to wrestle with data-driven, evidence-based systems. Below 100 employees, much of the HR function is outsourced and key hires are handled, with a good chunk of analysis, by the executives. Between 100 and 500 employees, the systems formalize and, again, resources are expended to make sure that the best systems and tools are used. Above 500 employees in this sector, things get really interesting. When human capital is seen and used as a business weapon, remarkable things happen.

The employment marketplace is vast. Over seven million firms employ 120 million people (the rest of the workforce works for the government). The black square represents the 24 million people in about 4 million companies who don’t use recruiting per se. The rest of the market is the ‘formal’ recruiting market.

So, how’s the picture? Do you think this is an accurate picture? Is there another way to portray the market?

I find the picture useful as a way of explaining how some things work. Economic pressure bears down on the top of the matrix. One way of thinking about the economy is that the thin strata of big companies are where money flows from into the smaller establishments in the food chain.

Technology adoption is a different story. It comes into our market from the right. The companies with transformative HR are almost always early technology adopters. The next 30 percent follow the best practices of the innovators. The remaining 60 percent buy technology when there is a rational dollars and sense argument.

Make sense?

I hope you’re enjoying this buildup to the ERE conference. Pinstripetalent has been kind enough to sponsor the work and research that makes the project possible.