What began with a frustrated CEO is turning into a new website for contingent recruiters and corporate recruiting departments to interact online, and handle the financial transaction, a bit like an escrow when you’re buying a house.

What irked this CEO was that one of his employees was placed by a recruiter, lasted 90 days, and then quit. The CEO ranted about it to a guy named Ken Winters. Winters heard the story — which not only involved the employee quitting, but the employee being recruited by the same original recruiter to a different job. In time, this led to Winters’ co-founding a new company called Job Escrow.

What irked this CEO was that one of his employees was placed by a recruiter, lasted 90 days, and then quit. The CEO ranted about it to a guy named Ken Winters. Winters heard the story — which not only involved the employee quitting, but the employee being recruited by the same original recruiter to a different job. In time, this led to Winters’ co-founding a new company called Job Escrow.

In short, here’s how it works.

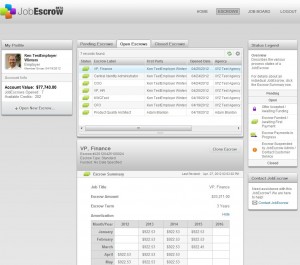

An in-house recruiter — say, for Microsoft or Home Depot — pays $410 to open up an escrow … a little like posting a job ad. This in-house recruiter chooses a third-party recruiter (who’ll pay nothing to join at the outset, but perhaps later a membership fee) from the system, based on profiles those recruiters have set up. The two parties work out a payment plan, based on monthly payments over one, two, three, or four years. JobEscrow takes the $410, but no cut of the recruiting commission. (Click the graphic to get a feel for what it looks like.)

There’s also an “Outplacement JobEscrow” service where a reward is given for helping laid-off employees get a job. The outplacement job escrow could be posted by a company like Sony that’s laying people off, or by an outplacement firm like Right Management and so on.

Kevin Grossman, a regular at corporate recruiting industry events who is consulting for JobEscrow, says the firm is doing beta testing, signing up recruiters, and planning on launching officially in July. He says the company is also in the process of getting certified as an escrow holding company.