Direct tech hiring may be a little soft today, but staffing firms are powering the recruiting market, looking to fill orders for temp and project workers that employers need, but are hesitant to bring on permanently.

“Staffing firms in the technology space are definitely very active today,” said Scot Melland, chairman, CEO and president of Dice Holdings, “and they’re seeing their businesses do pretty well.”

Speaking to financial analysts during a Q1 conference call this morning, Melland said, “Companies are still leaning towards outsourcing talents to contractors, as well as staffing firms, rather than hiring full time.”

That’s truer in some part of the country than in others, he said, noting that in Silicon Valley there’s an intense competition for tech talent, hamstrung by the reluctance of workers to change jobs. That not only adds to the demand for temp help, but it also explains why Dice.com has seen slight growth in its revenue in the first quarter of this year.

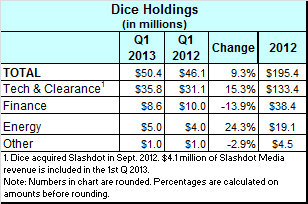

Dice Holdings, which owns and operates several niche job boards including Dice, reported this morning it earned 12 cents a share on $50.4 million of revenue, which put it mostly in line with what Wall Street was expecting and what the company predicted in January.

However, that was down a penny per share from the same quarter last year, and the analyst estimates were lowered after Dice issued a forecast below what Wall Street was looking for.

Dice also offered a second-quarter outlook forecasting revenue of $52 million; more than $2 million below what analysts were expecting before today’s financial release.

Dice stock today is down a bit more than 1% on the news. That’s not much, but over the last month, Dice has lost about $1.30 from its high of $10.25.

Dice stock today is down a bit more than 1% on the news. That’s not much, but over the last month, Dice has lost about $1.30 from its high of $10.25.

Dice is a well-managed company that operates in two of the hottest recruiting markets: IT and energy. (It also has a play in healthcare.) However, the slowness of employers to bring on full-time, perm staff has created what Melland characterized as a “largely stable” financial environment for the company.

“Overall,” he said, “Q1 was a good start to the year, particularly in light of the continued low levels of turnover in professional services, modest job growth and caution due to sequestration, especially in the government and defense sectors.”

Melland observed that tech workers are “generally less willing to change jobs. So you’ve got turnover still at levels that are lower than what we’d expect.” That impacts both direct hire firms and, as Melland explained, Dice’s business:

If tech professionals are nervous about switching from one opportunity to the next, then everything slows down. So it’s a daisy chain of recruiting assignments that happen. If someone leaves company A, they go to company B, that creates a hole in company A, which has to be filled. In a tight market, they’re going to steal somebody from company C, and that creates a hole that needs to be filled. So if there’s more movement that, that creates many more recruiting assignments, and that’s how the turnover really impacts recruiting.

Staffing firms are continuing to post jobs despite experimenting with social media, because, Melland said, “many of the candidates that they really want to reach are not naturally gravitating towards their brands. And so they need the third-party services to get these higher-skilled candidates that normally don’t think about working for those firms.”

For direct sourcing, he said LinkedIn was Dice’s primary competitor. Dice’s Open Web, a data mining tool launched a few months ago, is the company’s answer to LinkedIn’s profiles. Open Web searches the web and dozens of social platforms, building profiles of individuals who have been identified as candidates of interest. Open Web yields far more information about a candidate’s interests and professional involvements than does a standard resume. In that way, it’s significantly more objective than a LinkedIn profile, which is largely managed by the individual.

LinkedIn, which will report its 1st quarter results next month, is ny any account, a high flier, popular with both investors and recruiters. Its recruitment business alone doubled in 2012 to $524 million. Its stock today is trading at $187, up $9.66.

Melland noted during the conference, “Although it still accounts for a small percentage of total Dice usage, Open Web usage is growing and is having a positive impact on the renewals of the customers who use it.” For now, Open Web is part of the recruitment package contract. When it proves its value, the company look to monetize it on a pay-per-view basis.