Bullhorn is out today with a survey of staffing and recruiting firms that is so full of useful and enlightening information it’s hard to know where to begin.

Bullhorn is out today with a survey of staffing and recruiting firms that is so full of useful and enlightening information it’s hard to know where to begin.

Here’s just a sample of what the 20 page report covers:

- 77% of the 1,337 firms met or exceeded their revenue goals in 2013;

- Revenue per recruiter at the smallest firms averaged $266,000; at the largest firms it was almost twice that;

- Owners, CEOs, and partners of retained firms earned, on average, $230,000 last year. Those heading contingent firms averaged $149,000. Recruiters at retained search firms averaged $84,000. At contingent firms, they averaged $96,000;

- 75% of firms plan to grow their own headcount this year. Among contingent and retained search firms the percentages are 63% and 69% respectively;

- The most important metric firms track – placements. Least important – time to fill. 71% of the respondents said their placements increased last year; time to fill for permanent placements – 32 days;

- Average fee per permanent placement was $16,602.

The bottom line, says industry technology provider Bullhorn in this, its fourth annual survey, “2013 was by almost all accounts a very good year for the staffing and recruiting industry.”

There is, however, one troubling result that hints at a head-in-the-sand attitude among some respondents.

On the positive side, Bullhorn found 72% of respondents make at least half their revenue from repeat client business. That, notes the technology vendor, “demonstrates the

value of nurturing strong customer relationships and delivering sustainable results.”

However, nearly half of the larger firms get 70% or more of their revenue from a single client. Among all size firms, 22% of respondents said half or more of their revenue comes from only one client.

However, nearly half of the larger firms get 70% or more of their revenue from a single client. Among all size firms, 22% of respondents said half or more of their revenue comes from only one client.

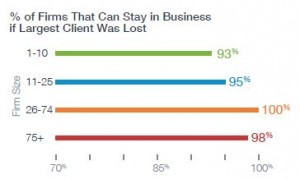

Yet, when Bullhorn asked them what would happen to the firm if that one client were lost, only 6% admitted they’d go out of business. Observes the report:

While several respondents at small, lower-midsize, and large firms felt at risk of shutting down if they lost their largest client, no respondents from upper-midsize firms (26-74 employees) felt vulnerable. Upper-midsize firms are most reliant on a single client, but are the least afraid of going under if they lose that client.

This fourth edition of North American Staffing and Recruiting Trends Report includes extensive breakdowns on contingent and retained search, as well as contract and temp agencies. Previous editions of the report included data on perm placement firms, but the breakouts were limited. This year’s report treats these agency types in detail, providing specifics for each in nearly every area of the results.

This is a welcome addition to the report, no doubt a consequence of Bullhorn’s increasing share of the pure search market. In November 2012 it acquired Sendouts and MaxHire, both of which were strong technology providers to the independent recruiting industry. The latest survey is the first since the acquisitions were completed.

This is a welcome addition to the report, no doubt a consequence of Bullhorn’s increasing share of the pure search market. In November 2012 it acquired Sendouts and MaxHire, both of which were strong technology providers to the independent recruiting industry. The latest survey is the first since the acquisitions were completed.

Also helpful to the vast majority of independent recruiters is that some of the key data is broken down by firm size. You won’t see that by type of agency — the sample size is likely too small — but you will get a sense of how other similarly sized firms are doing in revenue, compensation and in sourcing strategies.

In that latter category, how firms of different size view such sourcing methods as ATS database and referrals (the two most effective) and cold-calling (the least effective) varies little, except when it comes to job boards. The bigger the firm, the more effective it considers job board postings.

One possible explanation: the bigger the firm the more likely it is to have a temp staffing business, which relies on a constant stream of applicants. Bullhorn’s question about applicants per job posting suggests that may be the case, noting that temp agencies average 49 applications per job posting, the highest among the reported firms, though only two more than retained search firms get. You’ll also find a breakdown of applications by type of job advertised.

Among the other areas covered in the report: submissions per hire by agency type (contingent search has four, the same as temp), hit rates, fill rates, and growth rates.

What’s the biggest opportunity this year? Social media, says the report. And the biggest threat? No surprise here. It’s the lack of qualified candidates; 71% of respondents say there’s a shortage of skilled candidates in many areas, which the report conveniently breaks down by industry segment. The biggest shortage of skilled candidates is in — and this is a surprise — transportation.

“Technology – which in previous years had a critical shortage of qualified talent,” observes the report, “is running in the middle of the pack this year.”

One final interesting point. Bullhorn asked respondents to write in what they believe to be the single greatest quality of a successful recruiter. By a landslide, that trait is “persistence.”