Independent recruiting firms of all types and size had a good 2014 and 9 out of 10 of them expect an even better year in 2015.

Independent recruiting firms of all types and size had a good 2014 and 9 out of 10 of them expect an even better year in 2015.

On average, 77% of the firms participating in Bullhorn’s annual North American Staffing and Recruiting Trends Report said they met or exceeded their 2014 goals; 89% expect to increase revenue this year.

Yet, says Bullhorn, there are signs that the rapid growth of the last two or three years may be leveling off. Pointing to the 79% of agencies that reported more than half their income coming from repeat business, Bullhorn wondered if the rise from last year’s 61% who said that might “signal a reduced focus on expanding the client base.”

Two other indicators — little change from last year in the firms planning to increase headcount or open branches — “may suggest a tentative industry mindset in the wake of the recession of the late 2000s,” Bullhorn suggested.

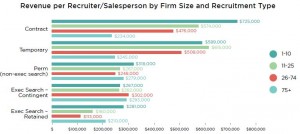

Still, a majority of respondents plan to increase headcount. The largest percentage was among staffing and contract labor agencies, with 8 out of 10 of them planning to hire during the year. The smallest percentage — 65% — was among firms with fewer than 1-10 workers regardless of specialty or niche.

This is just a sample of the data in the Bullhorn report. The report aggregated responses from 1,285 recruiting professionals representing all categories of independent recruiting: contingent and retained executive search; temp; contract labor; and perm. Respondents self-selected, based on the largest share of agency revenue.

The report contains a variety of performance measures including repeat business breakdowns, candidate sourcing, hit rate, fill rate and time to fill, in addition to detailing many of these by firm size, type and, in some cases, by industry niche.

For instance, 77% of respondents said their total placements grew in

2014, a 6 percentage point increase over 2013. Light industrial and finance & accounting roles grew the most — by 87%. Fill rate was considered the most important recruiting process metric by all firms, while total placements was the most important revenue driving metric. And that was true regardless of type of agency.

As might be expected, fill rate was highest for retained executive search firms, which reported an average 71% rate.

Contract labor firms came in at 40%, the lowest of the five categories. But, notes Bullhorn, “Given the percentage of contract jobs driven through VMS and the ‘first to submit is first to win’ philosophy that’s so prevalent in VMS business, this finding is equally unsurprising.”

Contract labor firms came in at 40%, the lowest of the five categories. But, notes Bullhorn, “Given the percentage of contract jobs driven through VMS and the ‘first to submit is first to win’ philosophy that’s so prevalent in VMS business, this finding is equally unsurprising.”

Similarly, retained search firms had the best hit rate at 58%; contingent search and contract tied for the lowest at 39%. The 39% average was nearly identical to last year’s 40% rate. On average, it took 5 candidates to get a placement.

Filling a job took an average of 19 days, but that includes temp and contract, both of which sectors are based on speedy response to a client’s job order. Retained search firms, which typically will be hired for the most demanding searches, took 51 days to fill a job, two weeks more than in 2013. Contingent search firms had the opposite experience, shortening their time to fill from 68 days to 28.

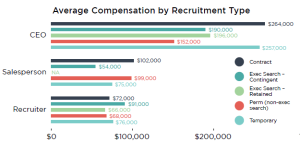

The highest pay was earned by owners, CEOs and other top agency executives. They averaged $197,000. When broken down by agency size, top execs at mid-sized firms had the highest compensation, on average earning between $315,000 and $337,000.Recruiters earned an average of $73,000. Those at firms with 75 or more employees, had the lowest average pay at $62,000. Those at firms with 1-10 employees earned the most at $77,000.