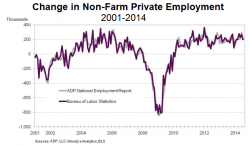

The hand-wringing over today’s ADP private employment report should not be taken as evidence of any kind of sudden reversal of hiring.

The hand-wringing over today’s ADP private employment report should not be taken as evidence of any kind of sudden reversal of hiring.

The 204,000 private sector jobs ADP and its forecasting partner, Moody’s Analytics, said were created in August demonstrates that the hiring surge of the last several months still has legs. That the number was less than the 215,000–220,000 jobs economists expected and the lowest count since March, may be disappointing, but the August dip is familiar to any recruiter with more than a few years experience.

Hiring historically slows in August and again around the end-of-the-year holidays. Last year, ADP reported 296,900 new jobs in June and 212,400 in July. In August, the job creation count dropped to 190,200. It was back up in September to 215,000.

The official government report from the U.S. Bureau of Labor Statistics, oddly, showed just the reverse last year, with a big jump in August hiring and lower hiring in July and September. However, for both the BLS and ADP, the August dip pattern held true in 2012 and 2011.

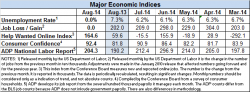

The government’s jobs report is due out tomorrow morning. Surveys of economists put the average of their estimates at 225,000 to 230,000 new, non-farm jobs. Unlike the ADP report, the BLS numbers include government jobs. The national unemployment rate is predicted to fall to 6.1 percent from 6.2 percent.

“The underlying trend here is still pretty strong,” Scott Brown told Bloomberg News. Brown is chief economist at Raymond James & Associates Inc. , and, according to  Bloomberg, the best forecaster of ADP payroll reports. “The labor market is improving but we still have a lot of slack.”

Bloomberg, the best forecaster of ADP payroll reports. “The labor market is improving but we still have a lot of slack.”

Mark Zandi, Moody’s chief economist, was more upbeat in his analysis of the August numbers. “Steady as she goes in the job market,” he said. “Businesses continue to hire at a solid pace. Job gains are broad based across industries and company sizes. At the current pace of job growth the economy will return to full employment by the end of 2016.

The ADP report, which Zandi oversees, said small businesses (under 50 employees) were again the biggest jobs creator, accounting for 78,000. Mid-sized employers (50-499 workers) increased headcount by 75,000. The balance came from employers with more than 500 workers; those with more than 1,000 adding 47,000 jobs.

Here’s how ADP reported job adds by sector:

- Construction 15,000

- Manufacturing 23,000

- Trade/transportation/utilities 28,000

- Financial activities 5,000

- Professional/business services 51,000.

Other reports issued during the week also showed steady economic growth. One, the manufacturing index from the Institute for Supply Management, surprised economists by rising to 59.0 from 57.1 the month before. A Reuters poll had economists expecting a slight decline to 56.9. Any number over 50 indicates expansion in the manufacturing sector.

SHRM’s LINE report predicts that manufacturers will increase their hiring this month; just over half of all manufacturers will add jobs, says SHRM, which bases its predictions on surveys of HR professionals. Hiring by service industries, which generate the largest share of new jobs, is expected to slow significantly.

Last month, The Conference Board reported its Consumer Confidence Index improved to 92.4, the highest reading since before the start of the recession.

Discussing the improvement, Lynn Franco, director of economic indicators, said, “improving business conditions and robust job growth helped boost consumers’ spirits. Looking ahead, consumers were marginally less optimistic about the short-term outlook compared to July, primarily due to concerns about their earnings. Overall, however, they remain quite positive about the short-term outlooks for the economy and labor market.”