Expansive hiring demand has largely been the name of the game over the last 10 years in China.

This is no longer the story, and it’s not just because the summer heat has kicked in. All the signs are that employers are cooling to the idea of hiring more staff. This is not a cause for immediate concern for third-party recruitment suppliers, or unrequited joy for HR departments, but there are signs of a general easing of skills demand.

The first source of comfort for HR departments is Hudson’s latest quarterly hiring report, which says professional hiring expectations in China have declined in the second quarter of 2008, after a prolonged and sustained rise.

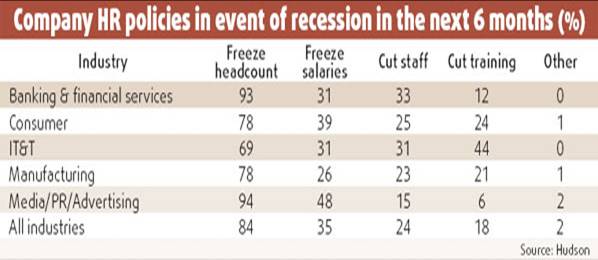

The fact that Hudson even asked companies what HR policies they would implement in the event of a recession is a sign of the changes to come.

A serious hiring slowdown is unlikely at this stage, but the Hudson report found that 14% of respondents in China expected the country would face a recession in the next six months. This is fewer than in any other Asian country.

Meanwhile, Manpower’s recent results for China are largely in agreement with Hudson’s. However, they focus more on manual positions and show 15% are having difficulties filling positions.

This compares favorably with 2007, when 19% of companies had difficulties. The closure of so many low-tech textile and furniture plants in the south of China may be freeing up labor, exactly as the government had planned.

Training and Productivity

With all this in mind, it may be time to think about getting more productivity out of existing staff. If China has really reached the Lewisian Turning point, as many economists have suggested, then there isn’t any longer a choice about doing this. If China has not reached the Lewisian Turning point this year, then it will very soon.

Training is the obvious first step to productivity improvements. Surprisingly, over the past few years, training has not been an obvious solution. Many companies in China feel as though they are the training ground for everyone else in their industry.

The classic scenario is that once staff have received training, they cash it in for a salary increase and a bigger title with a competitor company. When they choose their next employer, needless to say, the cycle continues as there is no change in their preference for companies with strong training programs.

This scenario is not true for many staff in China, but it is true for enough people that it has become a constant topic of conversation.

With even a small reduction in hiring demand, the likely result is that staff are going to stay longer, so it actually becomes worthwhile to train them. Training then becomes a way to hold staff, and if you can hold them longer, hiring needs lessen. The negative downward spiral of hire-train-lose turns upwards so that you get to hire-train-motivate-retain.

Even in hot industries, like banking, there is a degree of caution in hiring right now because some banks have yet to receive their licenses to operate in China.

Media, PR, and advertising continue their seemingly inexorable meteoric rise, and we can still look forward to one-year tenures and 100% salary increases. If your training programs have skills overlap with these industries, you may still have to watch out.

Expectations underwent the steepest fall in the consumer industry, plummeting to 45% from 72% in the first quarter, so hiring in retail should be hit to some extent. At the same time, there is also strong demand coming from new retail players. Retail’s revolving door may continue revolving for a while.