Like businesses all across the globe, SHRM had to dip into its reserves to cover expenses in 2009 when it came up $8.7 million short.

Like businesses all across the globe, SHRM had to dip into its reserves to cover expenses in 2009 when it came up $8.7 million short.

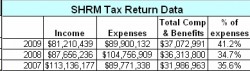

The organization’s recently posted 2009 tax return shows the Society for Human Resource Management spent $89.9 million in 2009, while taking in $81.2 million from dues, conferences, and advertising.

That compares to the $17.1 million deficit the organization ran up in 2008 when it spent $104.8 million, but took in only $87.7 million. In 2007, SHRM found itself with a $23.4 million surplus.

Because the data comes from tax returns (??non-profit returns are public), some of the expenses allowed by the IRS such as depreciation aren’t out of pocket. So the actual losses on operations are less. In 2009, depreciation, depletion and amortization came to $3.6 million. However, that still meant a year end cash deficit of $5.1 million.

Because the data comes from tax returns (??non-profit returns are public), some of the expenses allowed by the IRS such as depreciation aren’t out of pocket. So the actual losses on operations are less. In 2009, depreciation, depletion and amortization came to $3.6 million. However, that still meant a year end cash deficit of $5.1 million.

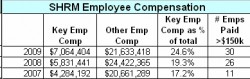

As is typical of a not-for-profit professional association, SHRM’s largest expense is salaries. In 2009, it spent $37.1 million on compensation and benefits. In 2008, that amount was $36.3 million. In 2007, it was $32 million.

Of the total in 2009, 25 percent of the total comp and benefits went to just 30 employees, who earned a combined $7.1 million. SHRM’s highjest paid employee in 2009 was China Gorman, then SHRM’s Chief Global Member Engagement Officer. She was paid $635,701 that year, which was about $63,000 more than (now former) CEO Laurence O’Neil was paid.

Of the total in 2009, 25 percent of the total comp and benefits went to just 30 employees, who earned a combined $7.1 million. SHRM’s highjest paid employee in 2009 was China Gorman, then SHRM’s Chief Global Member Engagement Officer. She was paid $635,701 that year, which was about $63,000 more than (now former) CEO Laurence O’Neil was paid.

By non-profit standards, SHRM’s pay structure is generous. Among organizations with incomes similar to SHRM’s, executives earn in a range from about $250,000 to $400,000 annually. That’s according to a database made available by The Chronicle of Philanthropy.

Charity Navigator, a non-profit, which maintains records on more than 5,500 publicly supported charities, puts the median CEO salary at $336,104 for organizations with incomes of $50 million to $100 million. Only at charities with budgets between $200 and $500 million is the median salary close to SHRMs. Charities that size pay their CEO $429,754 on average.

A third source, Economic Research Institute, says half the non-profits in employment related sectors with revenue comparable to SHRM’s pay less than $284,259. At the top end, organizations with revenues like SHRM’s pay around $401,000.

The growth in top salaries has been brisk since 2007, when the return listed 11 employees earning $150,000 or more. In 2008, 26 employees earned at least that. And in 2009 that number was 30. Most of the individuals listed in the report earn considerably more than $150,000.

SHRM was emailed asking for comment. The post will be updated when the response comes in.

990 IRS SHRM 2009 submission and analysis(2)(function() { var scribd = document.createElement(“script”); scribd.type = “text/javascript”; scribd.async = true; scribd.src = “http://www.scribd.com/javascripts/embed_code/inject.js”; var s = document.getElementsByTagName(“script”)[0]; s.parentNode.insertBefore(scribd, s); })();

Last week the SHRM Members for Transparency circulated to its members and chapter leaders a summary of the 2009 tax return. The SMFT is made up of a large number of well known and respected former SHRM board members, executives, and current SHRM members at issue with recent actions by SHRM’s Board of Directors and its leadership.

Although the group would not comment on the information int he tax return, the group’s emailed summary specifically points out the salaries of key members of the SHRM staff, the compensation paid to board members (which totaled $220,563), and detailed the amounts the organization is spending to support offices and staff around the world.

The group included membership numbers for the regions and a per member spending breakdown. The report said more money was spent supporting some 3,500 members in Asia, India, Canada, and Mexico than in support of the 70,350 chapter affiliated members in the U.S.

John Hollon, Vice President for Editorial of TLNT.com, contributed to this story. Contact him at john@tlnt.com, and follow him on Twitter at http://twitter.com/johnhollon