Every vendor in the recruiting space touts their latest recruiting and sourcing tool as the next killer app. If you were there, you saw many of them at the last ERE Expo in Florida in September. As the economy recovers, there will be many more at ERE’s Expo 2010 in San Diego next March. Some of them will be superb and worthy of serious consideration.

However, while many will work as advertised, getting budget for them is a different matter entirely. In the past, the only way to get any significant new expenditures past the CFO was with some type of rigorous cost-savings analysis. However, this approach ignored any improvements in candidate quality as possible justification due to its “intangible” nature.

But as Dr. John Sullivan has been ably pointing out for these past 10 years, improvements in candidate quality dwarf potential cost savings. In fact, one could easily justify a cost increase if quality of hire could be proven.

In this article, I’m going to introduce a means to calculate the ROI of any new recruiting program on a quality-of-hire basis. Further, I’m going to suggest that once you have a means to measure quality of hire, you’ll shift your focus toward improving it, and consider cost per hire a secondary priority.

While cost per hire is not unimportant, it’s far less important than quality of hire. In the HR field, ROI has traditionally been calculated based on the cost savings a new process generates in comparison to the investment. These savings traditionally involve recruiter productivity opportunities, the use of lower-cost advertising techniques, or the elimination of outside services like search agencies.

ROIs calculated on this basis only have value if the quality of the candidates seen and hired are the same. If quality declines, the associated cost savings are meaningless.

To get some perspective here, let’s look from a slightly different angle at the financial decisions of hiring — the amount of money your company will be spending on direct compensation for new hires in 2010. For example, if your company will be hiring 1,000 additional people next year at an average compensation of $60,000, you’ll be spending $60 million in additional annual compensation.

While this is a huge amount, most companies don’t look at the financial implications of each of these individual 1,000 hiring decisions from a quality standpoint, relying instead on the transaction costs involved in bringing these people on board. By incorporating quality of hire into the ROI analysis, the strategic consequences of this huge expenditure is more appropriately considered.

Measuring quality of hire starts with having some basic tools: first, a talent scorecard to measure incoming candidate quality and, second, a means to convert this into financial impact. With these tools, calculating quality of hire ROI is relatively straightforward. This is demonstrated graphically in the accompanying figure.

Measuring quality of hire starts with having some basic tools: first, a talent scorecard to measure incoming candidate quality and, second, a means to convert this into financial impact. With these tools, calculating quality of hire ROI is relatively straightforward. This is demonstrated graphically in the accompanying figure.

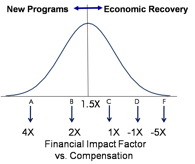

The graph represents the current mix of recent hires, assuming some type of normal distribution across all talent levels from A to F. As the economy recovers, there will be a natural tendency to push this mix to the right, reducing the quality. This can be offset by new programs which will improve the mix, pushing the curve to the left. In this case, the average is somewhere between a B and C level, typical of most companies.

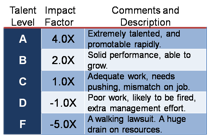

An impact multiplier needs to be assigned for each quality group in order to assess the financial contribution each level makes. In this case, it has been assumed that an A-level person makes a positive business contribution that’s equivalent to four times the person’s total compensation. The impact multiplier for a B-level is two times compensation; a C-level is considered break-even; hiring a D-level person results in a loss equivalent to their compensation; and the F-level cost is five times the compensation.

Developing the impact multipliers is the big assumption in this quality-of-hire ROI calculation, but for staff-level positions, the ones shown in the table are quite reasonable. (Click here for more background on this, including some charts, graphs, and a webinar podcast.) Theses multipliers increase dramatically for senior management, and are a bit lower for hourly and entry-level positions, but probably not much.

Developing the impact multipliers is the big assumption in this quality-of-hire ROI calculation, but for staff-level positions, the ones shown in the table are quite reasonable. (Click here for more background on this, including some charts, graphs, and a webinar podcast.) Theses multipliers increase dramatically for senior management, and are a bit lower for hourly and entry-level positions, but probably not much.

While you could use short-term performance reviews to determine quality levels post-hire, some type of talent scorecard needs to be used to evaluate candidates on a pre-hire basis. Logically, from a validation standpoint, it’s best to use the same evaluation process pre- and post-hire. Not having linkage pre- and post-hire has been one of the big problems in using quality of hire for developing ROIs for recruiting initiative.

More important, since most hiring mistakes are associated with hiring a good person for the wrong job, these “grades” must be based on performance, not generic quality descriptions. For example, a brilliant person who needs to be pushed to do the work is at best a C-level. Problems associated with these classic mismatches prevent companies from improving quality of hire, regardless of any great sourcing and employer branding programs. This is why I suggest measuring pre- and post-hire quality based on real job needs using a tool like the performance profile instead of a job description in combination with a multi-factor talent scorecard to measure end-to-end quality of hire.

Using these tools, calculating hire-quality ROI involves a number of steps:

First, calculate the average talent mix for your current hiring processes. To do this, take a sample of your recent hires, assigning each person a realistic quality grade. Then using some weighted average approach, determine your average talent mix. It’s probably somewhat below a B level, with a corresponding multiplier of 1.5X to 1.75X. (Email me if you’d like to participate in a quick SWAG assessment.)

Next, determine the financial contribution of this current talent mix. Multiply your current talent mix multiplier by the total compensation for the group to determine the financial contribution they collectively make to your company. In the example of 1,000 hires at $60 million at a B- mix and a 1.5X multiplier, this would be $90 million, for a net contribution of $30 million.

Now the fun begins. Now you need to determine how a new recruiting initiative improves your current talent mix. Any proposed recruiting initiative should be assessed on how well it improves the overall talent mix, not just how much it reduces costs. Graphically, this means moving the normal curve shown earlier to the left, meaning more As and Bs and less Cs, Ds, and Fs. To obtain a 10% quality of hire improvement, you’d need to hire 10% fewer below-average candidates, replacing them all with above-average candidates. Due to the weighting, a 10% quality shift like this increases the multiplier more than 10%. In the example above, this shift increases the multiplier from 1.5X to 1.75X. (Email me if you’d like to see the model and the math.)

Finally, calculate the quality-of-hire ROI by comparing the improvement in contribution to the cost of the initiative. As shown above, a 10% improvement in talent mix increases the multiplier from 1.5X total compensation to 1.75X. In the example, this means the net contribution of the 1,000 new hires increases from $90 million to $105 million, for a net increase of $15 million. This is an enormous impact, and indicates why quality of hire should be a far more important driver than cost per hire when evaluating new recruiting initiatives. Consider the ROI implications. If you spend $500,000 to obtain this quality improvement, you’d have a first-year quality-of-hire ROI of 2,900% ($15mm- $.5mm/$.5mm)!

Now for the good/bad news. Once the economy recovers, improving quality of hire will be more difficult, as the demand for talent exceeds the supply. As shown in the figure, these economic forces will have a tendency to worsen the talent mix as your best people are aggressively sought by the more aggressive recruiters, or they leave on their own for greener pastures.

Under improving economic conditions, preserving your current talent mix will become more challenging. In this case, preventing the impact of a reduction in talent mix should be used to calculate your quality-of-hire ROI.

Recruiting departments should be measured on how well they improve quality of hire, rather than a single-minded focus on cost/hire. The discussion should start by figuring out who’s responsible for it: recruiting, hiring managers, or both. Regardless, the impact of a minor improvement in quality of hire has such an enormous business impact that it’s irresponsible not to directly consider it in every hiring decision.